TDS Return Latest Update: You will know the last date of filing income tax, if you do not know, then we tell. The last date to file ITR is 31st July. Have you forgotten to file Tax Deducted at Source (TDS) return? If you have not filed the TDS return then you will have to pay a heavy fine along with the late fee.

1 lakh will be fined for not returning TDS

If you make any mistake in filing TDS return, then the Income Tax Department will charge a late fee of Rs 200 per day. In such a situation, while filing the return, first of all you will have to pay late fee for the delay. After this a fine (TDS penalty) will be imposed. In this case, the Income Tax Officer can impose a fine ranging from a minimum of Rs 10,000 to a maximum of Rs 1 lakh.

These documents are required to return TDS (Tax Deducted at Source)

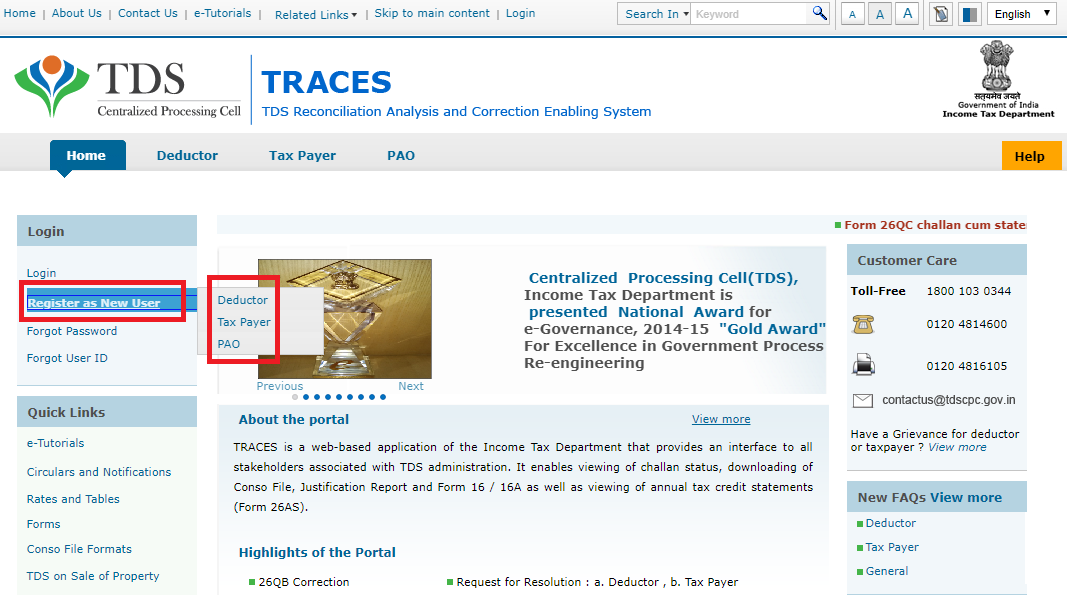

To file TDS return, the taxpayer will need Form 16 or 16A. Which is a certificate of deduction of tax on income on any kind of income. It contains all the details that the employer would have paid the tax in lieu of the employee. Taxpayer can also assess his TDS, TCS and advance tax through Form 26AS.

31st July is the last date

In ITR, you have to file the return of tds every quarter. The last date to file TDS (Tax Deducted at Source) return is 31st July. The TDS return must be filed by the last date of the coming month after the end of every quarter. April-June quarter returns up to 31st July, July-September quarter returns up to 31st October, October-December quarterly returns up to 31st January and January-March quarterly returns 31 Must be filed by May.