Sukanya Samriddhi Scheme Updates: The government has increased the interest rate for April-June quarter 2023 in Sukanya Samriddhi Yojana (SSY). Now the government will provide an interest rate of 8 percent per annum to the daughters.

The central government is running the Sukanya Samriddhi Yojana to advance the daughters and make them financially empowered. In which accounts can be opened only in the name of daughters through bank or post office. For which interest is paid by the government on a quarterly basis.

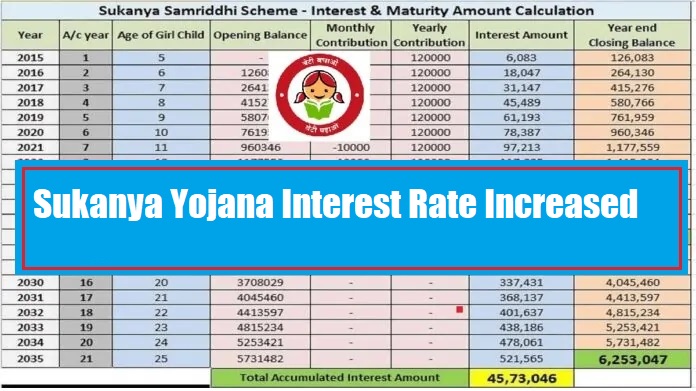

The government has increased the interest rate for the April-June quarter 2023 in Sukanya Samriddhi Yojana (SSY). Now the government will provide an interest rate of 8 percent per annum to the daughters. In this, 7.60 percent interest was given before the quarter from April to June. Which has now increased to 8 percent.

Through this scheme, the expenses of daughters’ education and marriage can be raised. Because investment in the account can be done till the age of 18 years. The amount can be withdrawn from the account when the daughter turns 21. The government keeps revising the interest rate in this. For the first quarter of the year 2024, the government has increased the interest by 40 bps.

If a parent starts investing in Sukanya Samriddhi Yojana in the name of his daughter as soon as she is born, then she will have to invest for the next 15 years. If he invests Rs 10,000 per month in the name of the daughter, then the daughter will become a millionaire when she turns 21.

Who can open Sukanya Samriddhi Yojana account ?

The account can be opened by the parent or legal guardian of the girl child from birth till she attains the age of 10 years.

Where can you open Sukanya Samriddhi Yojana account,

Sukanya Samriddhi Yojana accounts can be opened in post offices and authorized banks.

What is the minimum and maximum amount that can be invested in Sukanya Samriddhi Yojana account ?

Minimum deposit amount of Rs.250 per year and maximum amount of Rs.1,50,000 per year can be invested in the name of the girl child.

Can you open more than one Sukanya Samriddhi Yojana account for the same girl child ?

No, only one Sukanya Samriddhi Yojana account can be opened by the parent or legal guardian in the name of the girl child.

What if the account holder fails to deposit any amount in the Sukanya Samriddhi Yojana account in one or more financial years ?

If the customer does not deposit the minimum deposit of Rs 250 in a financial year, a penalty of Rs 50 per year will be levied on default.