Re-KYC Rules: It was said by the central bank that in such a situation self-declaration made by the customer would be sufficient. Similarly, the address etc. of the account holder can also be updated.

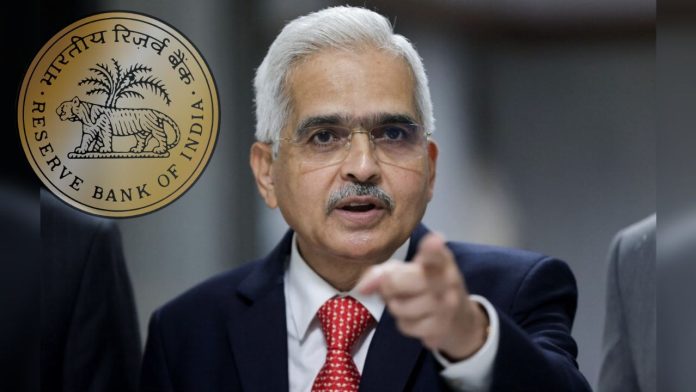

Reserve Bank of India KYC Rules: Reserve Bank of India (RBI) has issued a new order for banks regarding KYC. It was told by RBI that if you have done KYC once, then you do not need to go to the branch again to get re-KYC done. It was said on behalf of the central bank that in such a situation self-declaration made by the customer would be sufficient. Similarly, the address etc. of the account holder can also be updated.

Bank will verify within two months

Banks have been told by the RBI that it is not necessary for the customer to visit the bank for re-KYC of the customer. It was said in the order that in this situation the facility of KYC should be provided to the account holder through email-id, registered mobile number, ATM, digital channel. On behalf of RBI, it was said that if there is a change in the address, then the customer can submit his updated address to the bank through any medium. Within two months of this, the address declared by the bank will be verified.

In some cases, the KYC process has to be started again.

The Reserve Bank further said that since banks are required to update their records from time to time. Therefore, in some cases, the KYC process may have to be started again. This happens only in cases where the list of documents is not available or the validity of the documents required for KYC has expired. In such cases the bank needs to obtain the KYC documents produced by the customer.