Unified Lending Interface: The Reserve Bank of India (RBI) has started the pilot project of its latest technological initiative ULI. It will soon be implemented across the country. The system of giving loans has been simplified through ULI. With this, customers will get instant loan in a very short time. Its big benefit will be to those who take loans of small amounts.

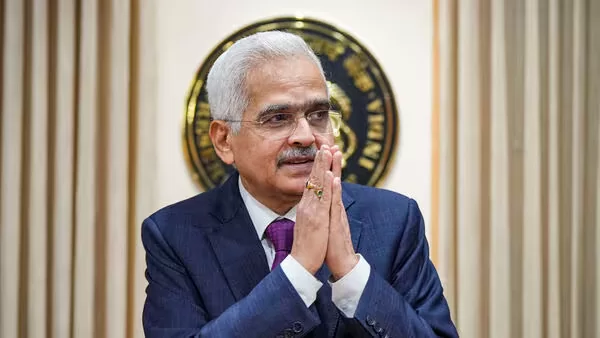

The Reserve Bank of India (RBI) is preparing to bring Unified Lending Interface (ULI) on the lines of Unified Payment Interface (UPI). After its arrival, it will become easier to take loans. RBI Governor Shaktikanta Das has given this information in a program. Its biggest benefit will be to those who take loans of small amounts. Especially small businessmen will get the benefit. Shaktikanta Das said that last year (August 2023) the Reserve Bank launched a pilot project of a technical platform for frictionless credit. During one year after the launch, the focus on this platform was on Kisan Credit Card Loan, Dairy Loan, MSME Loan, Personal Loan and Home Loan.

The RBI governor said that after the experience of the pilot project, the Unified Lending Interface (ULI) will soon be launched across the country. He said that just as the UPI payment system has brought a big change in the entire digital payment ecosystem, similarly the Unified Lending Interface will bring big changes in the lending space of India.

Who will get the benefit of ULI?

The government and RBI have limited control over the existing apps that provide instant loans. But the government will directly monitor the best apps on the ULI platform. Just like you make payment by entering the PIN through UPI, you will be able to get a loan by entering the PIN. This ULI will be linked to the bank account. The Unified Lending Interface (ULI) will make the entire system of taking a loan easier. It has been designed to reduce the time and paperwork taken in credit processing. On its launch, especially farmers and MSMEs will be able to get quick loans. The ULI app will collect data from different sources including AADHAAR, e-KYC, state government land records, PAN validation and account aggregator.

UPI was launched in 2016

Shaktikanta Das said that the Unified Payment Interface (UPI) was launched by the National Payments Corporation of India (NPCI) in April 2016. UPI has achieved a lot of success in its 8-year journey. In July 2024, 1,444 crore transactions were done through Unified Payment Interface i.e. UPI. During this, a total of Rs 20.64 lakh crore has been transferred.

Related Articles:-

Belated ITR: What is the process for filing belated income tax return, what is the penalty?

What is GNSS that will replace Fastag on highways for toll tax

NIL ITR: What are the benefits of filing ‘Zero Return’? know in details