RBI ULI System: The Reserve Bank of India (RBI) launched a pilot project of a new scheme last year to promote digital banking.

The name of this scheme was Frictionless Credit Platform, which aimed to simplify the process of taking a loan. Now the name of this platform has been changed to “Unified Lending Interface (ULI)”.

Digital banking will get a boost

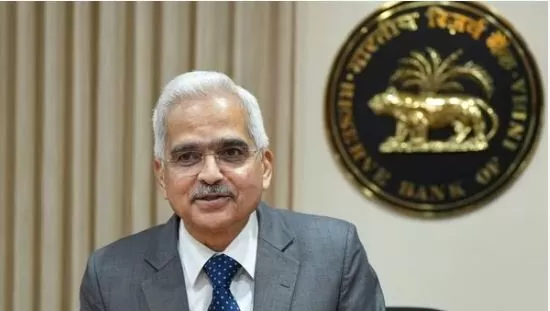

During his speech in Bengaluru, RBI Governor Shaktikanta Das said that ULI will make the loan process simpler and faster. This will make it easier for banks and non-banking financial companies (NBFCs) to give loans. Because loan giving institutions will get important digital information like land records from one place, which will reduce both the time and paperwork taken in the loan process.

Small villages and towns will benefit

The RBI Governor said that the biggest beneficiaries of ULI will be the small villages, towns and small-medium enterprises (MSMEs) of the country. ULI has been designed on the basis of Plug and Play model, so that any institution can easily adopt it. Based on the good experiences of the pilot project, ULI will soon be implemented across the country.

Also Read:- Petrol Diesel Price: Check fuel rates in your city today

Just like UPI changed the way of payment, ULI can also bring a significant change in the loan disbursal process. This will prove to be a big advantage for the people of small towns and villages.

There has been a change in the banking system

DPI broadly refers to the basic technology systems built in the public sector that are openly available to users and other developers. Das said that there has been an unprecedented technological change in the traditional banking system in the last decade. All signs suggest that this process may accelerate even more in the coming years.

Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday said the central bank is constantly working to create policies, systems and platforms that will make the financial sector strong, resilient and customer-centric. Speaking at the Global Conference on Digital Public Infrastructure and Emerging Technologies under the RBI@90 initiative, Das said digital public infrastructure (DPI) and emerging technologies will shape the future journey of almost all economies in the world.

Governor Das said this

On the country’s experience with DPI, he said, “DPI has enabled India to achieve a level of financial inclusion in less than a decade, which would otherwise have taken decades or more to achieve.”

Related Articles:-

New Pension: 8 lakh railway employees will get the benefit of UPS, Know How?

SEBI is ready to ease the conditions for registration of investment advisors