State Bank of India (SBI), HDFC Bank and ICICI Bank have once again been declared Domestic Systemically Important Banks (D-SIBs) by the Reserve Bank of India. RBI released the list of D-SIBs banks today, Wednesday, 13 November.

Last year also, these three banks got the status of Domestic Systemically Important Bank. Banks included in the D-SIBs list are considered very important for the domestic system. Along with this, they are also considered the safest banks in the country. These are such banks which are so important for the system that if they sink, the entire economy can get a shock. These types of banks are so important that if something happens to them, the government itself will try to save them.

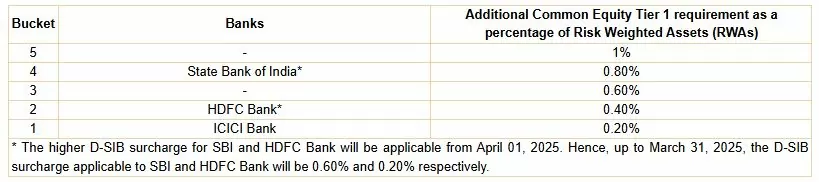

The Reserve Bank of India has prepared the list of D-SIBs banks on the basis of data received till March 31, 2024. Banks considered important for the domestic system have to maintain Additional Common Equity Tier-1 (CET1). They have to maintain more Common Equity Tier 1 as per their bucket. This is the capital through which risks can be easily managed. Banks included in the list of D-SIBs have to keep it more.

The concept of D-SIBs was implemented in 2014

The Reserve Bank of India first adopted the concept of D-SIBs 10 years ago in 2014 to prepare a list of banks important for the domestic system. In 2015, State Bank of India and then in the next year i.e. 2016, ICICI Bank was included in this list. In 2017, HDFC Bank entered this list.

Which bank is in which bucket?

This time RBI has placed State Bank of India in bucket-4, under which it has to maintain 0.80 percent additional CET1. At the same time, HDFC Bank also remains in bucket 2 and it has to maintain 0.40 percent high CET1. ICICI Bank has been placed in bucket 1 and it will have to maintain an additional 0.20 percent in the CET1 buffer. The new rules will come into effect from April 1, 2025.

Related Articles:-

DRDO Recruitment 2024: Govt Jobs Fellowship Without Written Test Salary One Lakh