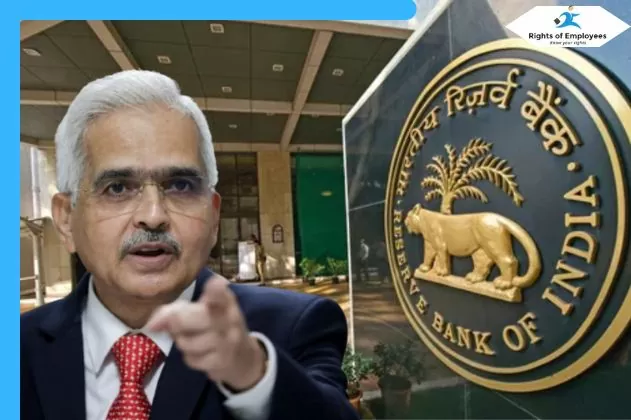

RBI issued an order: Reserve Bank of India has imposed a fine of lakhs of rupees on five cooperative banks for ignoring the rules. Let us know on which banks action has been taken.

The Reserve Bank of India has imposed fine on five cooperative banks for ignoring the rules. The banks on which RBI has taken action include Indapur Co-operative Bank Limited, The Patan Urban Co-operative Bank Limited, Pune Merchants Co-operative Bank Limited, Jankalyan Co-operative Bank Limited and Pune Municipal Corporation Servants Co-operative Urban Bank Limited. The Reserve Bank has imposed fine on these banks for different reasons. In such a situation, will it affect the customers? Let us know about this.

How much fine was imposed on which bank?

A fine of Rs 5 lakh has been imposed on Indapur Cooperative Bank and Pune Bank. The central bank has taken this action due to ignoring the rules of deposit account and minimum balance maintenance. Mumbai-based Jankalyan Co-operative Bank Limited has neglected to follow the rules of credit information. For this reason, RBI has also imposed a fine of Rs 5 lakh on this bank.

Apart from this, a fine of Rs 2 lakh has been imposed on The Patan Urban Co-operative Bank of Satara for ignoring the RBI rules on Banking Regulation Act 1949. Action has been taken against Pune Merchants Co-operative Bank Limited for not maintaining adequate information about deposit accounts. RBI has imposed a full fine of Rs 1 lakh on the bank. A penalty of Rs 1 lakh has been imposed on Pune Municipal Corporation Servants Cooperative Urban Bank for not sharing correct information about inoperative accounts.

RBI said this

While taking action against cooperative banks, RBI said that RBI has no intention of interfering in the functioning of banks. Action has been taken against all the banks due to ignoring the rules and it will not affect the customers. All these banks will continue to function normally.

License of this bank cancelled

Recently, the Reserve Bank has canceled the license of Urban Cooperative Bank Limited located in Sitapur, Uttar Pradesh. RBI has completely banned the functioning of the bank from December 7. This action has been taken in view of the deteriorating financial condition of the bank. According to the Central Bank, the bank had neither capital left nor any hope of business. In such a situation, keeping in mind the security of customers’ capital, the Reserve Bank has canceled the license of this bank. After the license of this bank is cancelled, up to Rs 5 lakh deposited in the account will be covered under insurance.