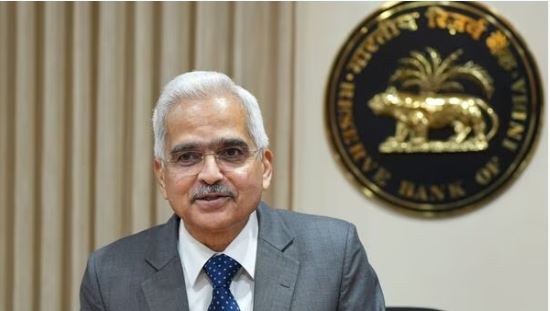

RBI MPC Meeting 2024: The 3-day meeting of the Monetary Policy Committee (MPC) chaired by the RBI Governor will begin on 6 February. Governor Shaktikanta Das will announce the committee’s decision on February 8.

RBI MPC Meeting 2024: Right after the Interim Budget 2024, the Reserve Bank of India (RBI) is likely to continue the status quo on the repo rate. Experts say that the Central Bank is unlikely to make any changes in the policy rates in its upcoming bi-monthly monetary policy this week,

because Retail Inflation is still close to the upper level of the satisfactory range. The 3-day meeting of the Monetary Policy Committee (MPC) chaired by the RBI Governor will begin on February 6. Governor Shaktikanta Das will announce the committee’s decision on February 8.

The Reserve Bank (RBI) has kept the repo rate stable at 6.5% for almost a year. It was last increased from 6.25% to 6.5% in February 2023. Retail inflation was at a high of 7.44% in July, 2023 and has declined since then. However, this is still high. Retail inflation was 5.69% in December, 2023. The government has entrusted the Reserve Bank with the responsibility of keeping inflation within the range of 4% with a variation of 2%.

Know when rates may be cut

Bank of Baroda Chief Economist Madan Sabnavis predicted that the MPC will maintain status quo in both rates and stance. He said that this is because according to December data, inflation is still high and there is pressure on the food side.

ICRA Chief Economist Aditi Nair said that CPI based inflation is expected to come down in the financial year 2024-25, although the trend of monsoon will be important for this. He said, we do not expect any change in rates or stance in the upcoming review. A rate cut can be seen only in August 2024.