RBI has directed banks to make it mandatory for all retail and MSME (Micro, Small and Medium Enterprises) loans to provide ‘key fact statement’ (KFS) to borrowers including interest and other terms and conditions.

The Reserve Bank of India (RBI) has made it mandatory for banks to provide ‘key fact statement’ (KFS-key fact statement) including interest and other terms to borrowers for all retail and MSME (Micro, Small and Medium Enterprises) loans. It was decided to do so on Thursday. At present, KFS is mandatory in respect of loans given by commercial banks to personal loan borrowers, digital loans by RBI regulated entities (RE) and micro finance loans.

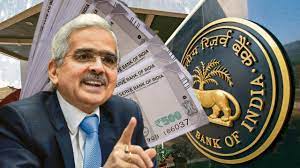

What did Governor Shaktikanta Das say?

Announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said the central bank has recently announced a number of measures to promote greater transparency and disclosure by REs in pricing of loans and other charges levied on customers. One such measure is to require lenders to provide their borrowers with a KFS containing key information regarding the loan agreement in a simple and easy to understand format. “It has been decided to make it mandatory for all REs to provide KFS to borrowers for all retail and MSME loans,” the governor said. Das said important information about the terms of the loan agreement including all-inclusive interest cost. Providing this will greatly help the borrowers in making an informed decision.

RBI also announced an important step regarding hedging of gold price risk in the over-the-counter (OTC) market at the International Financial Services Center (IFSC), GIFT City, Gandhinagar. To protect resident institutions from gold price risk, they were allowed access to IFSC recognized exchanges in December 2022. Das said that this decision has been taken to avoid fluctuations in the price of gold in the OTC segment in IFSC. The Central Bank will issue related instructions separately.

Announcement on regulation of electronic trading platform also

Meanwhile, RBI also announced a review of the regulatory framework for electronic trading platforms (ETPs). Governor Das said that over the last few years, there has been increased integration of the ‘onshore forex’ market with the ‘offshore’ market, significant evolution in the technology landscape and increased product diversity.

Market makers have also requested access to offshore ETPs offering permitted Indian Rupee (INR) products. Das also announced RBI’s intention to enhance the security features of the Aadhaar Enabled Payment System (AEPS), which was used by 37 crore people in 2023.

“To enhance the security of AEPS transactions, it is proposed to streamline the ‘onboarding’ process including mandatory due diligence for the ‘AEPS Touch Point Operator’ to be followed by banks,” Das said. Instructions will be issued soon. Currently, Das said, lenders are using the SMS method to comply with additional factor authentication requirements, but advances in technology have opened up new means.

“To facilitate the use of such mechanisms for digital security, it is proposed to adopt a framework for principle-based authentication of digital payment transactions,” he said.