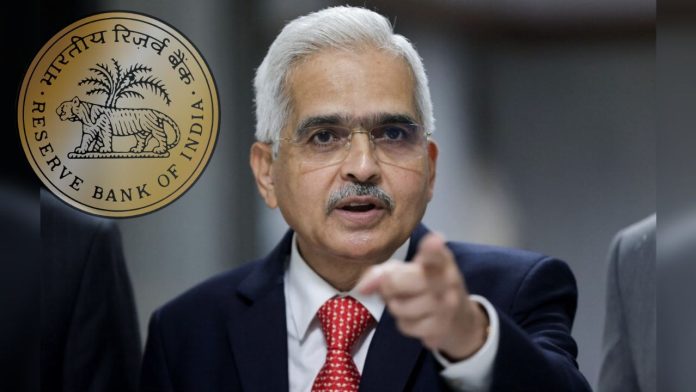

Reserve Bank of India: If your bank account is in a co-operative bank, then you must read this news. Banks have been facing strict action from the Reserve Bank (RBI) for the last few years.

The effect of this is that the RBI even canceled the licenses of some banks. Not only this, the central bank has also imposed heavy fines on some big banks. Co-operative banks are facing the maximum loss in the Reserve Bank’s action.

Reserve Bank also imposed penalty 114 times

The licenses of eight co-operative banks have been canceled by the RBI in the financial year 2022-23 ending on March 31. Reserve Bank has also imposed penalty 114 times on these banks for not following the rules. Let us tell you that banking service has expanded rapidly in rural areas through co-operative banks. But due to the irregularities coming to the fore in these banks, RBI had to take drastic steps.

Allegations of negligence in rules

Co-operative banks are facing interference from local leaders apart from dual regulation and weak finance. The Reserve Bank has started cracking down on co-operative banks, which are negligent in the rules. Permits of eight banks have been canceled in the last one year. Let us know which banks’ permits were canceled by RBI?

Licenses of these banks were canceled

1. Mudhol Co-operative Bank

2. Milath Co-Operative Bank

3. Shree Anand Co-Operative Bank

4. Rupee Co-operative Bank

5. Deccan Urban Co-operative Bank

6. Laxmi Co-operative Bank

7. Sewa Vikas Co-operative Bank

8. Babaji Date Mahila Urban Bank

The licenses of the banks mentioned above by the RBI were done due to insufficient capital, non-compliance with the rules of the Banking Regulation Act. Also canceled due to reasons like lack of future income possibilities. Co-operative banking sector is being monitored by RBI for the last several years. The central bank has canceled the licenses of 12 co-operative banks in the year 2021-22, 3 co-operative banks in 2020-21 and two co-operative banks in 2019-20.

Related Article