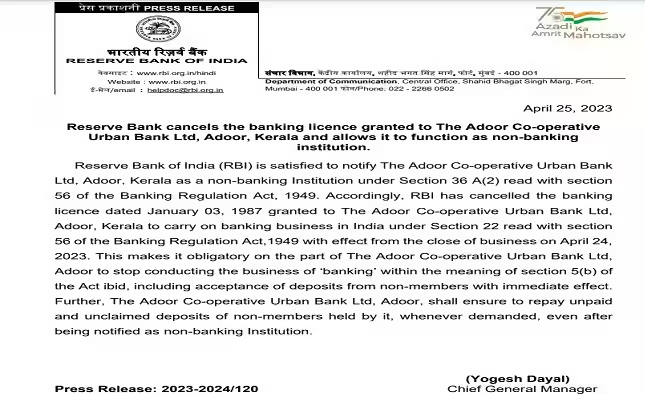

RBI Cancel Banking License: The Reserve Bank of India has canceled the license of a co-operative bank for non-compliance of banking rules. RBI has canceled the banking license of Kerala-based Adoor Co-operative Urban Bank. However, it has been allowed to work as a non-banking finance company (NBFC) by the central bank.

Let us tell you that on Monday, RBI has imposed a fine of lakhs on 4 cooperative banks for violating different norms. These include Tamil Nadu State Apex Co-operative Bank, Bombay Mercantile Co-operative Bank, Janata Sahakari Bank and Baran Nagrik Sahakari Bank. A fine of Rs 44 lakh has been imposed on these banks.

License canceled on 24 April 2023

According to the notification issued by RBI, the cancellation of the bank’s license has become effective from the close of business on April 24, 2023. On behalf of RBI, it was said that Adoor Co-operative Urban Bank Limited was given a banking license on January 3, 1987 for banking business in India under the Banking Regulation Act. The notification of cancellation of the bank’s license has become effective from the close of business on April 24, 2023.

What will happen to depositors’ money?

Account holders of Adoor Co-operative Urban Bank will get the benefit of insurance cover on deposits up to Rs 5 lakh. This insurance is available from the Insurance and Credit Guarantee Corporation (DICGC). DICGC is a subsidiary of the Reserve Bank, which provides financial security to the customers of the Co-operative Bank.

Customers having deposits of Rs 5 lakh or less with Adoor Co-operative Urban Bank will get full claim from DICGC. But such customers who have more than Rs 5 lakh deposited in their account, they will not be able to get the full amount.