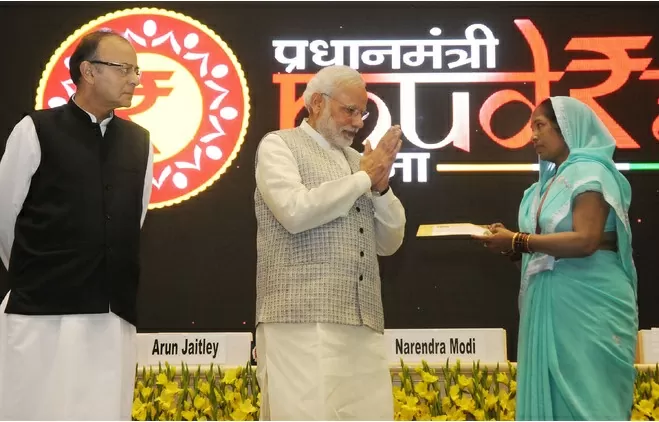

PM Mudra Yojana: The government has doubled the limit of Pradhan Mantri Mudra Yojana (PMMY), a loan given to promote self-employment in the country, to Rs 20 lakh. The Ministry of Finance said in a statement on Friday, through this increase we want to further the overall objective of the Mudra Yojana (PM Mudra Yojana). A notification has been issued in this regard.

Finance Minister announced in the budget

While presenting the Union Budget 2024-25 on July 23, 2024, Finance Minister Nirmala Sitharaman had said that the limit under the Pradhan Mantri Mudra Yojana (PMMY) will be increased from the current Rs 10 lakh to Rs 20 lakh.

“The limit of Mudra loan will be increased from the existing Rs 10 lakh to Rs 20 lakh for those entrepreneurs who have previously availed loan under the ‘Tarun’ category and have successfully repaid it,” Sitharaman had said while presenting the budget in the Lok Sabha.

What is the eligibility

- The person applying for the loan should be a citizen of India.

- The person applying should not have a bank default history.

- Any business for which Mudra loan is to be taken should not be a corporate entity.

- The person applying for the loan must have a bank account.

- The person applying for the loan should be above 18 years of age.

Loan is available in three categories

If you want to take a loan through Pradhan Mantri Mudra Yojana, then you can apply for a loan in any government-private bank along with regional rural bank, small finance bank, non-financial company. According to the category, 3 limits of loan amount have been made, which are called Shishu, Kishor and Tarun.

Benefits of PMMY

- Through Pradhan Mantri Mudra Yojana, you can take a loan of Rs 50 thousand to Rs 20 lakh according to your need. The loan is collateral free, and there is no processing fee on it.

- The total period of repayment of the loan under this scheme ranges from 12 months to 5 years. But if you are unable to repay it in 5 years, then you can extend its period by 5 years.

- Another good thing about this loan is that you do not have to pay interest on the entire amount of the loan sanctioned. Interest is charged only on the amount that you have withdrawn and spent through the Mudra card.

- Even if you are doing business in partnership, you can still take a loan through Mudra Yojana. In this, you get loan in three categories. The interest rate varies according to the category.

Apply like this

- First of all go to the official website of Mudra Yojana mudra.org.in .

- The home page will open on which information about three types of loans Shishu, Kishor and Tarun will be displayed. Choose the category as per your requirement.

- A new page will open, from here you will have to download the application form, take a printout of this application form.

- Fill the application form correctly. Some photocopies of documents will be required in the form like Aadhar card, PAN card, proof of permanent and business address, copy of income tax return and self tax return and passport size photo etc.

- Submit this application form to your nearest bank. The bank will verify your application and the loan will be given within 1 month.

- To apply online, you will have to create a user name and password. With its help, you will be able to login to the Mudra loan website. You can apply online here.