New Pension Plan: At present, every person is worried about his future. For this, he keeps thinking about such a plan, so that he can live his retirement life in a safe way, so we have brought such a plan for you.

If you are a senior citizen, then today we have brought such a government scheme for you, from which you will get a hefty pension immediately. In this your principal money remains safe and returns are also available at regular intervals.

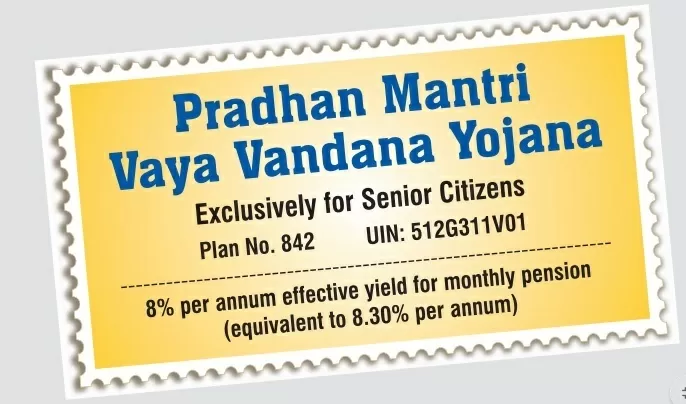

The best part is that under this government scheme, both husband and wife together after the age of 60 can avail the guaranteed benefit of pension of Rs 18500 every month. Thek best part is that after 10 years your entire investment will also be returned. Only a few months are left for senior citizens to invest in Pradhan Mantri Vaya Vandana Yojana (PMVVY). SIC operates this scheme.

In the PMVVY scheme, the government provides a subsidized pension scheme for senior citizens aged 60 years and above. Under this scheme, immediate monthly, quarterly, half-yearly or annual pension facility is given to senior citizens. Investors have to pay a lump sum of Rs 15 lakh to take advantage of this scheme.

Deadline is March 31, 2023

Any person who has attained the age of 60 years can invest in this scheme till March 31, 2023. With only a few months left for the PMVVY sale to end, let’s take a look at how much benefits, eligibility and how much pension senior citizens can get by subscribing to this scheme.

Eligibility for PMVVY

According to the LIC website, senior citizens of India aged 60 years (completed) and above can invest in the PMVVY scheme. There is no upper age limit to buy this plan.

PMVVY Scheme Term and Pension Payment

The duration of this scheme for senior citizens is 10 years. Pension payment under PMVVY can be made on monthly, quarterly, half yearly or yearly basis depending upon the mode chosen by the buyer. The first installment of pension under PMVVY starts after 1 year, 6 months, 3 months or 1 month from the date of purchase of the scheme. For example, if you have opted for monthly mode of pension payment and if you buy the plan now then your pension will start after 1 month.

PMVVY Pension Purchase Price

The minimum pension allowed under investment in PMVVY is Rs 1000 per month while the maximum pension is Rs 9250 per month. The minimum purchase price available under the scheme is Rs 1,62,162 for monthly pension, Rs 1,61,074 for quarterly pension, Rs 1,59,574 for half yearly pension and Rs 1,56,658 for annual pension. The maximum purchase price available under the scheme is Rs 15 lakh for monthly pension, Rs 14,89,933 for quarterly pension, Rs 14,76,064 for half yearly pension and Rs 14,49,086 for annual pension.

Interest Rate on PMVVY

“For Financial Year 2022-23, the Scheme shall provide an assured pension of 7.40% p.a. payable monthly. This assured rate of pension shall be payable for the full policy term of 10 years for all the policies purchased till 31st March, 2023.”

PMVVY Pension Purchase Price

The minimum pension allowed under investment in PMVVY is Rs 1000 per month while the maximum pension is Rs 9250 per month. The minimum purchase price available under the scheme is Rs 1,62,162 for monthly pension, Rs 1,61,074 for quarterly pension, Rs 1,59,574 for half yearly pension and Rs 1,56,658 for annual pension. The maximum purchase price available under the scheme is Rs 15 lakh for monthly pension, Rs 14,89,933 for quarterly pension, Rs 14,76,064 for half yearly pension and Rs 14,49,086 for annual pension.