PAN-Aadhaar Linking: The central government has issued a new guideline regarding linking PAN and Aadhaar. This rule will apply to those who got their PAN card made through Aadhaar enrollment ID.

All such PAN card holders will now have to give their real Aadhaar number to the Income Tax Department, so that their PAN and Aadhaar can be linked. This usually happens when someone’s Aadhaar number is not issued at that time. The last date for this has been fixed as 31 December 2025.

If the Aadhaar number is not given by this deadline, then many problems may be faced in the future. This is especially important for those who have to file income tax returns. Such people should complete the process of PAN-Aadhaar linking before 31 July, so that there is no problem while filing the return.

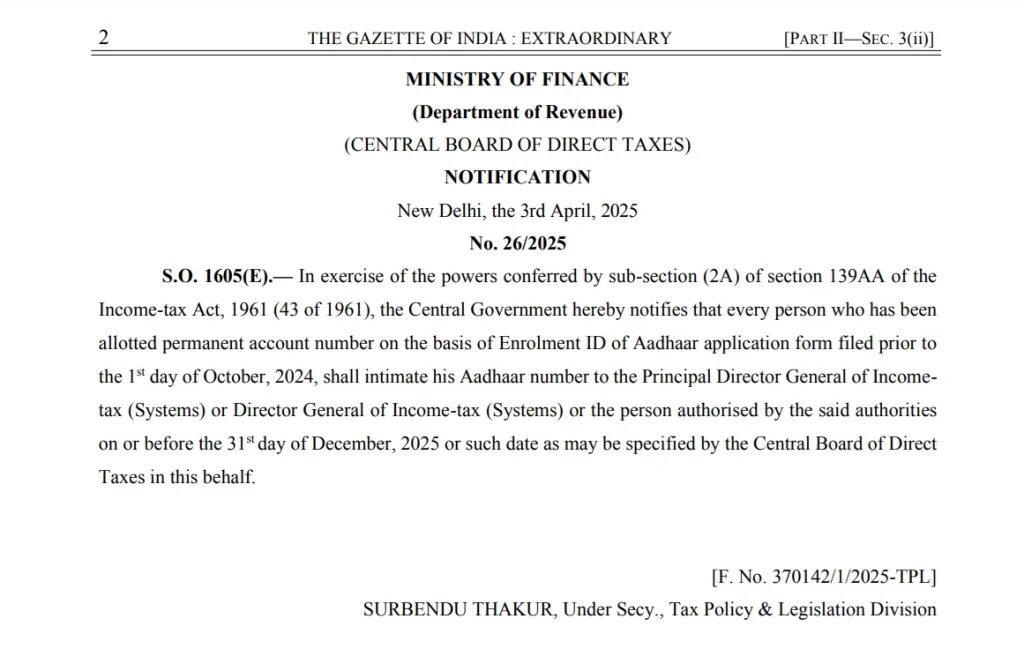

Read official notification

According to Notification No. 26/2025 issued by the Central Board of Direct Taxes (CBDT), those who have been issued PAN card on the basis of Aadhaar enrolment ID before October 1, 2024, will be required to provide their Aadhaar number to the Income Tax Department by December 31, 2025.

This direction has been issued under section 139AA (2A) of the Income Tax Act, 1961. The notification clarifies that the concerned person has to provide his Aadhaar number to the Principal Director General (Systems), Director General (Systems) of the Income Tax Department or the person authorized by them within the prescribed time limit.

Things required to link PAN-Aadhaar:

- Valid PAN number

- Aadhaar Number

- Active mobile number

How to pay fees online for PAN-Aadhaar linking:

Step 1: Visit the e-filing portal

First of all, go to the income tax e-filing website. Click on ‘Link Aadhaar’ in the ‘Quick Links’ section on the homepage. If you want, you can also go to the ‘Profile’ section after logging in and click on ‘Link Aadhaar’.

Step 2: Enter PAN and Aadhaar number

Enter your PAN and Aadhaar number and then click on ‘Continue to Pay’.

Step 3: Generate OTP

Re-enter your PAN and enter any mobile number to get OTP. After verifying the OTP, you will be redirected to the e-Pay Tax page.

Step 4: Click on Income Tax tile

Now proceed by clicking on ‘Income Tax’ option.

Step 5: Select assessment year and payment type

Select the assessment year and choose ‘Other Receipts (500)’ in the payment type. Then click on ‘Continue’.

Step 6: Make payment and link Aadhaar

The fee amount will be pre-filled here. Click on ‘Continue’, after which the challan will be generated. Select the payment mode on the next screen. Visit the bank website and make the payment.

After paying the fees, you can link PAN with Aadhaar by visiting the e-Filing portal.

Related Articles:-

Bank of Baroda’s 400-day special FD scheme getting the highest interest to customers

Vande Bharat Express: Railway Board Can Provide 4 New Vande Bharat Trains to this City, check routes

LPG Cylinder Price: IOCL has fixed the prices of 14.2 kg LPG cylinders for 6 April 2025. check here