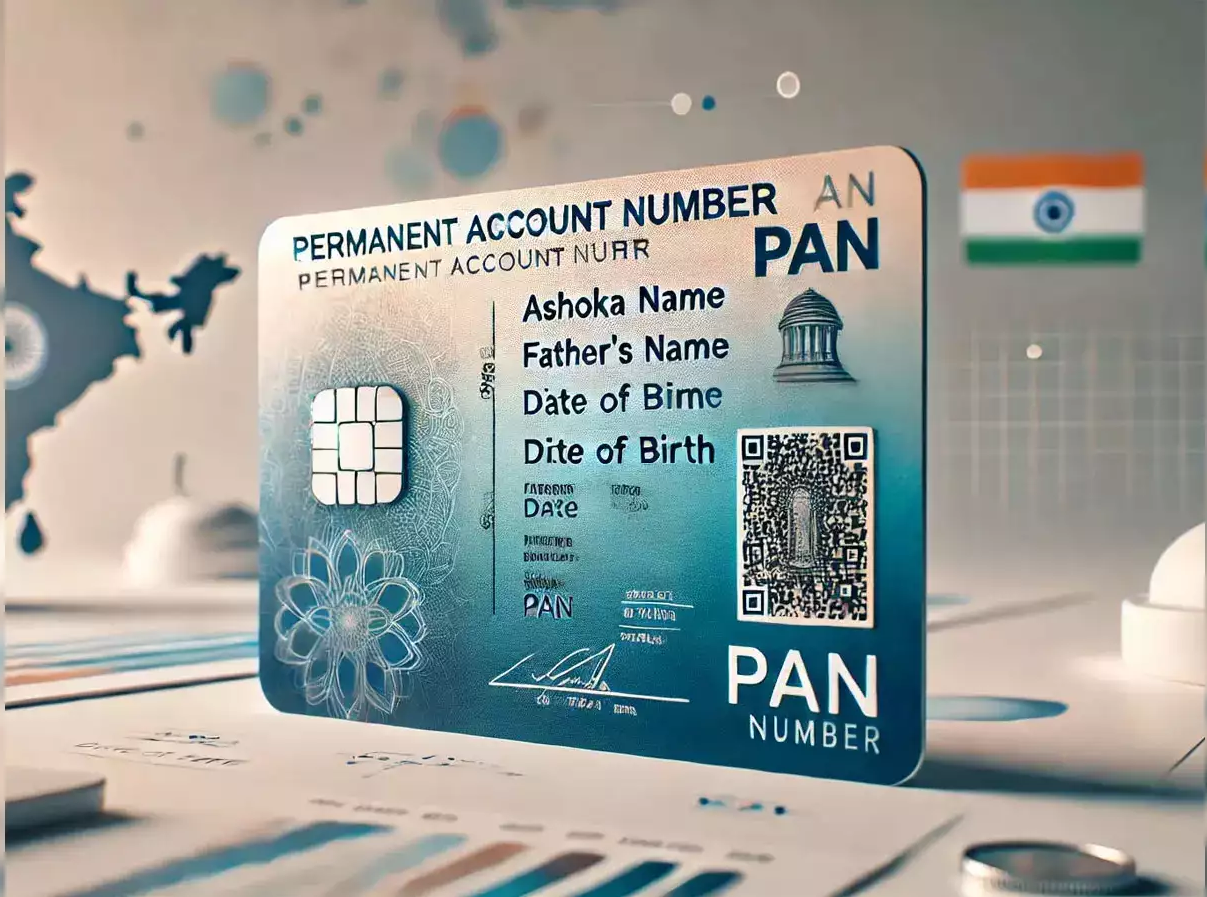

PAN 2.0: PAN has been an important document in India’s tax system. PAN number works as the identity of taxpayers. Now the government has announced PAN 2.0. This is the latest version of the existing PAN system. This new PAN has been designed to keep pace with digital times. Like Aadhaar is used in many services. Let us know the benefits of PAN 2.0 and what impact it will have on taxpayers. Is it necessary for taxpayers to get a new PAN 2.0?

What is PAN 2.0?

PAN 2.0 is the latest and safe version of the existing PAN. Many new changes have been made in it.

Digital Integration

Like Aadhaar, PAN 2.0 will also be linked to multiple platforms, making identity verification easier.

You will get PAN immediately

Now the process of issuing PAN will be fast and real-time. Till now it takes 10 to 15 days for the physical PAN to arrive. It takes a minimum of 3 days for the e-PAN to arrive in the email.

Strong link with Aadhaar

Linking of Aadhaar and PAN will be further strengthened to prevent misuse of PAN.

Biometric security : Biometric data is likely to be added to the new PAN, making it even more secure.

PAN 2.0 will have better and updated features than before.

Taxpayers and common citizens will benefit from PAN 2.0

PAN 2.0 can be used like Aadhaar for all purposes like opening a bank account, investing and tax filing.

PAN 2.0 will curb fraud. Biometric and Aadhaar integration will prevent identity theft and misuse of PAN.

PAN 2.0 will make tax filing easier. Filing your income tax return (ITR) will be faster and error-free than before.

Considering the financial needs, this will be the only document for all the work.

Benefits for businessmen

PAN registration will be faster for works like GST, corporate bank account and government tenders.

It will reduce tax evasion due to better tracking system. KYC process will be faster and easier due to biometric features.

Will existing PAN holders have to apply for the new PAN 2.0?

Existing PAN holders do not need to apply afresh for PAN 2.0. Their existing PAN will also remain valid. A new PAN will be issued only in case of correction or update.

However, along with the benefits, PAN 2.0 will also have some challenges.

Keeping biometric data safe will be a priority. It will be a challenge to implement the new system in rural areas and areas lacking technical facilities.

Related Articles:-

Belated ITR Filing Last Date: Here’s a complete guide to filing a belated ITR for the FY 2023-24

Bank Customers ALERT! This bank service will not be available on THESE 2 dates – Check Details

Weather Forecast: Alert of dense fog in 17 states, warning of rain in 5 states – Details Here