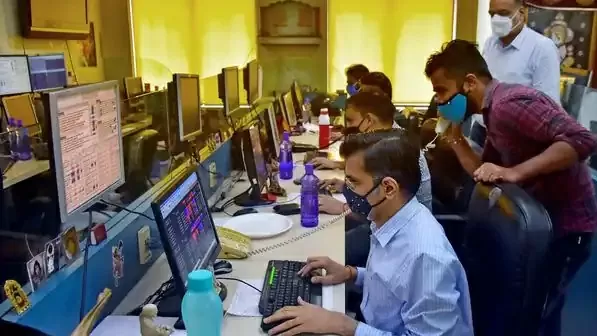

Market regulator SEBI has proposed that a facility like Application Supported by Blocked Amount (ASBA) should be made mandatory for qualified stock brokers (QSBs) to provide it to their clients in the secondary market.

In a discussion paper released recently, the capital market regulator proposed to provide UPI block mechanism phase-wise in the cash segment for individual and Hindu Undivided Family (HUF) clients of QSBs. The UPI block mechanism is a system in which investors can trade in the secondary markets by blocking funds in their bank account instead of transferring them in advance to their brokerage firm.

The money will be debited from the bank account only when the shares are credited to the investor’s demat account. This mechanism is already available in the secondary markets on an optional basis. It is similar to the ASBA mechanism, which applicants use while bidding for shares in an IPO. This has helped in significantly reducing the overall timeline of the IPO process. It will help in reducing

many types of risks

SEBI believes that this system will help protect investors’ funds from any possible misuse. “Thus, the process of blocking funds and trading in the secondary market through the UPI facility mitigates the risk of misuse of the clients’ assets or loss of their assets due to default by the brokers,” SEBI said. Another advantage from the investor’s point of view will be that the blocked funds will continue to earn interest in the individual’s savings account. The policy of brokers will be reduced.

Also Read: Vistara flights will not be operated on any route from November 12, 2024

The SEBI paper said, “The analysis shows that clients hold an average daily cash balance of about ₹ 65,276 crore with their TMs in the cash segment. Assuming an average interest rate of 4% on this cash, the total annual interest for collaterals held in the cash segment would be approximately ₹2,611 crore.” SEBI said that this move will reduce the float income of brokerage firms from such balances and they may have to adjust brokerage rates to compensate for such loss of implicit income.

SEBI said that the overall result of this will be a more transparent and efficient ecosystem mechanism of transaction costs for investors in competitive scenarios. According to SEBI, this system will help in reducing the incidence of misuse of client cash collateral held by members and not given to the clearing corporation.

Along with this, it will also help in reducing the risk associated with the wrongful withdrawal of client cash collateral by members from the clearing corporation and the risk of non-settlement of payments to clients by trading members. Beta version of trading through block mechanism in secondary markets January 1, 2024 was launched for individuals and HUFs, which is applicable only to the cash segment. SEBI believes that “this system may become a popular way for retail investors (individuals and HUFs) to trade in the securities markets, provided the TMs are willing to adopt this system.”

Related Articles:-

Ration Card Rules: Govt issued new rules regarding ration, These people will suffer a big loss

You will get 5% rebate on property tax, facility is available after paying till when