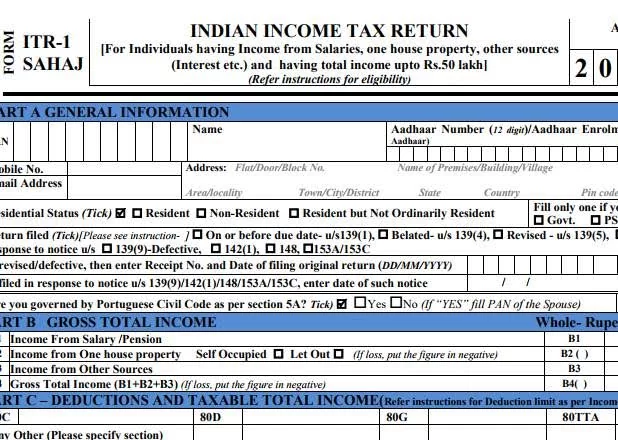

New ITR Forms Rules: The Income Tax Department has notified the Income Tax Return Forms for the financial year 2021-22. Taxpayers will now have to provide some additional information as well. There have been 9 changes from this time, which you have to keep in mind while filing ITR.

Income Tax Department for the financial year 2021-22 or assessment year 2022-23. Income tax return forms have been notified. No major changes have been made in the forms this time, but still some things have changed (New ITR Forms Rules). Taxpayers will now have to provide some additional information as well. If these changes are not known, then it is possible that you may have some problem in filling the form. Let us know about 9 such information that you have to give while filing ITR.

1- Enhanced category for pensioners In

ITR forms, pensioners will have to provide information about the source of pension. Pensioners have to choose one of the few options in the Nature of Employment drop-down menu. If there is a Central Government pensioner then choose Pensioners – CG, if there is a state government pension then choose Pensioners – SC, if getting pension from a public sector company then choose Pensioners – PSU and rest of the pensioners choose Pensioners – Others, which includes EPF pension Is.

2- Declaration of taxable interest in EPF account

If you contribute more than Rs 2.5 lakh in a year to EPF, then you will have to pay tax on the interest earned on the additional contribution. You will have to mention this interest in the ITR form.

3- Date of purchase or sale of building or land

If you have bought or sold any land between 1st April 2021 to 31st March 2022, then from this year you will also have to give the date information. You have to mention the date of purchase or sale under Capital Gains in the ITR form.

4- Information about the renovation of land or building every year, the information

you have spent on the renovation and improvement of land or building, you will have to give information on year to year basis. This cost has to be deducted from the sale price to arrive at long-term capital gains. From this year onwards, you are also required to give this information.

5- Actual cost of acquisition

While reporting capital gains, till now only index cost was required to be reported, but from this year onwards, you will have to provide index cost as well as original cost.

6- Additional information to support the residential status

While filing ITR, you are required to state your residential status. This year if you are filing ITR-2 or ITR-3 form, you will have to select the required option to support the residential status. In this you will get many options, in which you will have to tell how long you have been living in India. Earlier also, residential status was asked in ITR forms. However, this year very accurate information is being taken to ensure correct residential status.

7- Information about deferment of tax on ESOPs

As announced in the budget of 2020, employees of a startup can defer tax on ESOPs received by them for the future. However, there are some terms and conditions for this as well. This time while filling the ITR form, the employee will have to mention the amount of tax deferred. The taxpayer will have to give details such as the amount of tax deferred in the financial year 2020-21, tax due in 2021-22, the date on which he ceased to be an employee of the company, the amount of tax to be deferred for the next year, the balance.

8- Foreign assets and earnings

If someone has assets abroad or has earned dividend or interest on any asset from abroad, then it is necessary to give information while filing ITR. ITR Form-2 and ITR Form-3 can be used for this.

9- Details of property sold outside

India All the details of the property such as the buyer and the address of the property have to be given.