Mutual Funds: Crores of people invest in Mutual Funds and over the years the schemes subject to market risk have given better returns. If you also want to get good returns in the long term, then you can invest in mutual funds through SIP. Saving 5000 rupees a month can make you the owner of more than 2.5 crores.

There has been a big change in the attitude of people regarding savings and investment, so now crores of people are investing in equity market and mutual funds in addition to traditional savings scheme for better returns. Generally, the returns available in mutual funds are higher than bank savings schemes. However, this return remains subject to market risk.

You must have often heard people saying that they have got good returns by investing in mutual funds. Now the question arises that can you also collect huge funds for the future with the help of mutual funds? Of course, you can do this but for this you have to invest in mutual funds with planning.

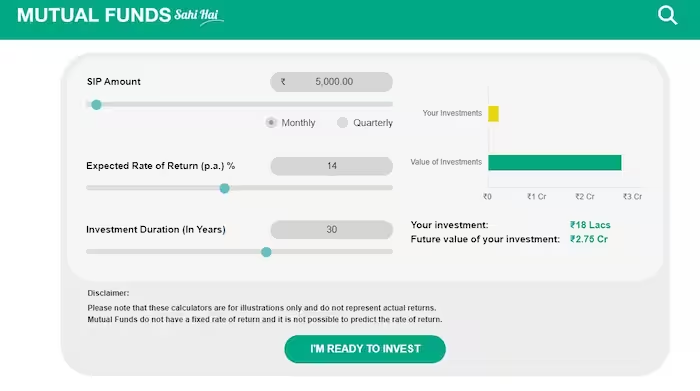

Investing in equity markets and mutual funds over the long term has been a profitable deal and the numbers prove it. You can earn up to Rs 2.75 crore through mutual funds in the long term by saving Rs 5,000 a month. Let’s know how?

According to the SIP calculator available on the website of The Association of Mutual Funds in India, investing Rs 5,000 per month in SIP will give you a return of up to Rs 2.5 crore after 30 years based on a potential return of 14% per annum, whereas during this period In this you will deposit only 18 lakh rupees. However, this is purely a potential return, as it is subject to market risk.

Disclaimer: Investment in Mutual Funds is subject to market risk therefore must take the help of a financial advisor before investing. The figures given here regarding the returns are for information only and reflect the possible returns. Investment without expert help can prove to be harmful and Rightsofemployees will not be responsible for the same.