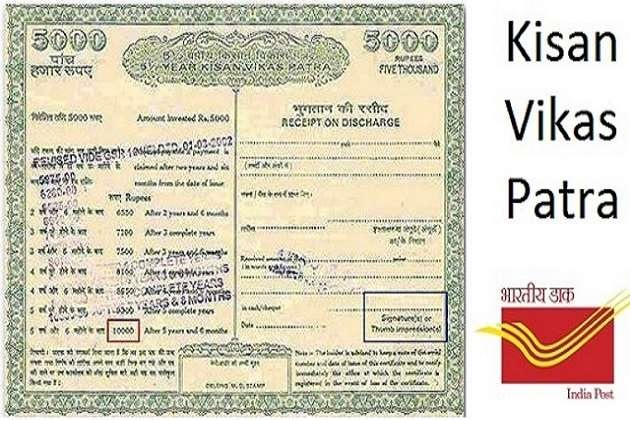

Post Office Money Double Scheme: Along with excellent interest in the post office schemes, the government also guarantees the safety of the money invested. Kisan Vikas Patra is also considered a money doubling scheme.

Everyone saves some amount from their income and wants to invest it in a place where they not only get a strong return but also keep their money safe. One such Post Office Scheme is Kisan Vikas Patra or KVP Scheme, the special thing about which is that it doubles the investors’ money in just 115 months. Let’s know about this special scheme in detail…

Money doubling scheme

If you also want to earn more money without taking any risk, then this popular scheme of post office Kisan Vikas Patra (KVP) can prove to be great. This scheme was started especially to give more profit. By investing in this government scheme, the money gets doubled in 115 months (Double Income Scheme). You can invest at least Rs 1000 in multiples of 100. The special thing is that there is no maximum limit in this. You can invest as much money as you want.

How many accounts can be opened under the scheme?

Both single and double accounts can be opened under the Kisan Vikas Patra Scheme. An account can also be opened in the name of a child above 10 years of age under this government scheme. Also, a person can open any number of accounts. There is no limit on this either. 2, 4, 6 You can open as many accounts as you want under the Kisan Vikas Patra Scheme.

7.5% interest

Under this scheme of the post office, the interest is decided on a quarterly basis. At present, 7.5% interest is being given under this scheme of the post office. This interest is issued on an annual basis.

Get Rs 10 lakh by investing Rs 5 lakh If someone invests Rs 5 lakh under this scheme and stays in this scheme till maturity i.e. 115 months, then he will get Rs 5 lakh only from interest on the basis of 7.5 percent interest. This means that investors will get Rs 10 lakh on maturity. It is worth noting that tax is included in this.

The government had earlier reduced the maturity period of Kisan Vikas Patra from 123 months to 120 months. Now it has been further reduced to 115 months. According to the information available on the post office website, interest on the amount invested in Kisan Vikas Patra is calculated on a compounding basis. In this scheme, interest on the amount invested is calculated on a compounding basis.

Related Articles:-

Why did UAE ban Pakistani citizens, not giving visa, know the reason

Bank KYC Update: RBI reprimands banks for freezing accounts due to lack of KYC. check Details

Direct tax collection may exceed the budget target of Rs 22.07 lakh crore in 2024-25