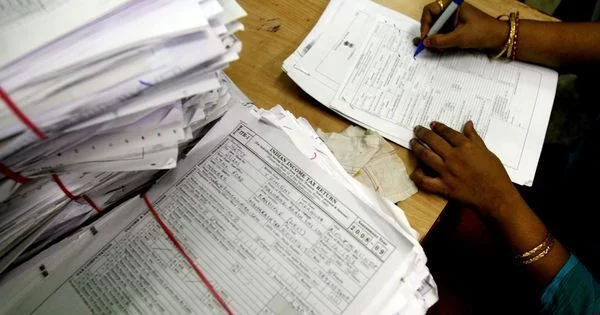

Income Tax Return 2023: The time to file income tax return has started. In such a situation, if you are also a taxpayer, then you should start doing income and tax assessment.

However, since the tax filing season has just begun, you still have plenty of time. Still, the sooner you get done with tax filing, the better, because filing tax returns in India requires some preparation.

What are FY and AY?

The return you are currently filing is for income earned in the financial year 2022-23, i.e. for income earned between April 1, 2022 and March 31, 2023, you will file the return. The assessment year is the review year for FY 2022-23, where you will file your returns and declare your investments for tax assessment. For income earned during the financial year (here FY 2022-23), the assessment year will be the immediately following year, i.e. 1st April 2023 to 31st March 2024. Therefore, the assessment year will be the assessment year 2023-24.3

Also Read: School Holiday List Released: Big relief for student! Schools will remain closed for so…

Know about the last date for filing ITR

Taxpayer category and due date for tax filing – FY 2022-23 (unless extended)

Individuals / HUF / AOP / BOI (books of accounts not required to be audited): 31st July 2023

- Business (requires audit): 31 October 2023

Businesses requiring transfer pricing report (in case of international/specified domestic transactions): 30 November 2023

-

- Revised Return: 31 December 2023

- Delayed/Late Return: 31 December 2023

What is the due date for filing returns for trusts?

For the trusts whose accounts are not required to be audited for the financial year 2022-23, the due date of return filing is 31 July 2023. Suppose the trust has to furnish a report under section 92E in Form No. 3CEB, then the due date for filing ITR will be 30 November 2023.

Also Read: Golden years FD for Senior Citizens! ICICI Bank has extended the deadline for the…

What is the due date for return filing for companies?

The due date for return filing of domestic companies for the financial year 2022-23 is 31 October 2023. However, if the company has any international transaction or specified domestic transaction and is required to furnish a report in Form No. 3CEB u/s section. According to 92E, the last date for filing ITR will be 30 November 2023.

What is the last date to file ITR?

The last date for filing ITR is 31st July of the relevant assessment year for individuals and 31st October for taxpayers whose accounts are under audit.

Know what are the things needed to file ITR

For ITR file, you have to collect many types of documents and many types of proofs for this. In such a situation, you should know that when you go to file ITR, what things you will need.

-

-

- PAN Card (PAN Card for Income Tax Return)

- Aadhaar Card (Aadhaar Card for ITR Filing)

- Form 16

- Form-16A/ Form-16B/ Form- 16C

- Salary Slip

- bank account details

- Bank Passbook/Statement

- Investment Proof

- Form 26AS

- Income from other sources

-