Income Tax Slab: Budget 2023 is going to be presented in a few days. During this, people have high expectations from this budget. Many announcements can be made in the budget and this time taxpayers are also cin the budget.

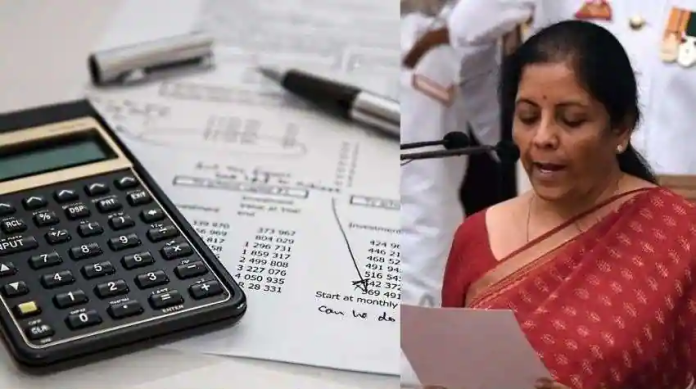

People are hopeful that many tax relief announcements can be made by the government in this budget and tax slabs can be changed. On February 1, 2023, the budget speech will be given in Parliament by Finance Minister Nirmala Sitharaman.

Budget 2023 In such a situation, we are going to give you information about the tax slab before the budget. At present, tax is collected according to two tax slabs. In this, the name of one is Old Tax Regime and the name of the other is New Tax Regime. Today we are going to update you about the amount on which 5% tax is levied in both the tax slabs.

Income Tax First talk about Old Tax Regime, then if your age is less than 60 years, then according to the financial year 2022-23, you will have to pay 5% tax on income between Rs 2.5 lakh to Rs 5 lakh per annum. On the other hand, if your age is between 60 to 80 years, then you will have to pay 5% tax on income from Rs 3 lakh per annum to Rs 5 lakh per annum.

Income Tax Slab Apart from this, if tax is to be filed according to the New Tax Regime according to the financial year 2022-23, then people of all ages will have to pay 5% tax on income between Rs 2.5 lakh to Rs 5 lakh per annum.