Income Tax News Updates: 31 July 2022 has been fixed as the last date for filing income tax returns for the financial year 2022-23. There are only a few days left for this deadline to end. This time the Finance Ministry has given a big relief to the middle income group by making a big change in the income tax rates.

However, it has to be kept in mind that you will get the benefit of the new income tax rates only if you do not take advantage of any kind of deduction and tax exemption. Taxpayers who want the benefit of deduction and tax exemption can continue with the old system of tax. Let us know what has changed in the tax rates.

No change in tax rate on such income. Income of Rs 2.5 lakh will not be taxed. This discount was already there. No changes have been made to this. Income from Rs 2.5 lakh to Rs 5 lakh will also attract 5 per cent tax as before. People with income above Rs 5 lakh have got a big relief.

Tax rate reduced on income above Rs 5 lakh, now income of Rs 5 lakh to Rs 7.5 lakh will attract 10 per cent tax. Income from Rs 7.5 lakh to Rs 10 will now attract 15 per cent tax. Income between Rs 10 lakh and Rs 12.5 lakh will now attract 20 per cent tax. Income between Rs 12.5 lakh and Rs 15 lakh will now attract 25% tax. Those earning more than Rs 15 lakh will be taxed at 30 per cent as before.

New and old rates of income tax

| revenue | update rate | old rate |

| Up to Rs 2.5 lakh | Zero | Zero |

| Rs 2.5 lakh to Rs 5 lakh | 5 percent | 5 percent |

| Rs 5 lakh to Rs 7.5 lakh | 10 percent | 20 percent |

| Rs 7.5 lakh to Rs 10 lakh | 15 percent | 20 percent |

| 10 lakh to 12.5 lakh rupees | 20 percent | 30 per cent |

| 12.5 lakh 15 lakh rupees | 25 percent | 30 per cent |

| Above Rs 15 lakh | 30 per cent | 30 per cent |

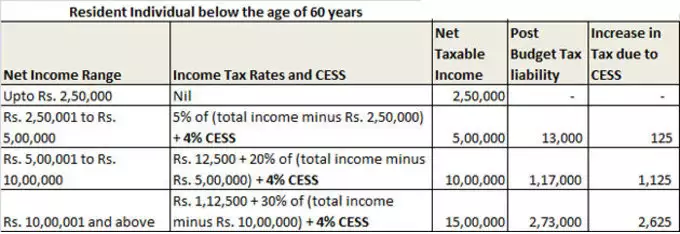

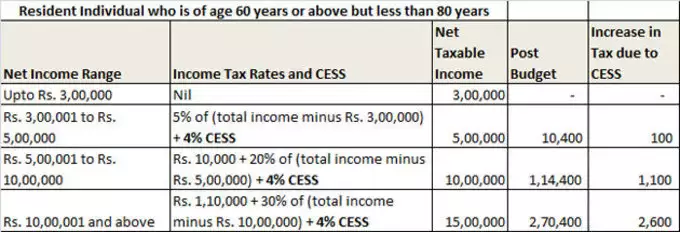

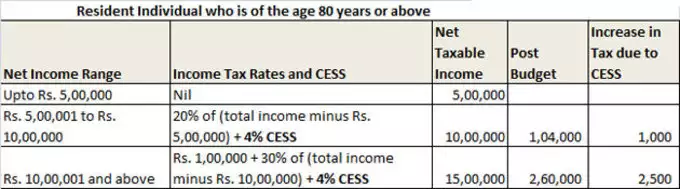

After filing the income tax return, if you become a tax liability, then you have to pay tax to the central government. If you are filing Income Tax Return (ITR) on your own, then you should know how much tax the government charges on the annual income.

It is mandatory for every person earning income from job, business or profession in India to pay income tax. The condition for this is that your income exceeds the general limit of tax exemption of Rs 2.5 lakh.

In this case, the relief is available only to those people whose earnings are less than the basic exemption limit. Let us know about the slabs set by the government for tax exemption or tax liability.

Tax exemption on investment of 1.5 lakhs

If you invest in tax saving investment options under section 80C, then through this, you can get tax exemption on investments up to Rs 1.5 lakh.

National Pension System (NPS), Voluntary Provident Fund (VPF) and section 80D as well as section 24 of the Income Tax Act, you can save tax on certain expenses separately.

Income tax is levied on the income of an individual in a phased manner. As your earnings increase, so will the tax rate. In fact, the tax rates are decided according to the income slab. The government reviews the income tax slab rate every year in the Union Budget.

First slab of 5%

If the taxable income is between Rs 2.5 lakh and Rs 5 lakh, then 5% tax will have to be paid on it. Keep in mind that taxable income is arrived at after deducting the amount of tax benefit on investments and expenses etc. made for tax saving from the total income.

Second slab of income tax of 20%

On the same lines, you had to pay income tax at the rate of 20% on income of five to ten lakh rupees.

Third slab of 30 %

The third income tax slab for the common taxpayer was 30%. For this, your annual taxable income should be more than Rs 10 lakh.