Income Tax Return Filing: The deadline for filing income tax return for the assessment year 2022-2023 is July 31, 2022. The government has categorically refused to extend its last date. Meanwhile, many users on Twitter are demanding the Income Tax Department to extend the deadline immediately.

Union Revenue Secretary Tarun Bajaj on Wednesday said that the government is not planning to extend the last date for filing ITR this year. At the same time, social media users have complained that the e-filing website is not working properly, so the deadline should be extended.

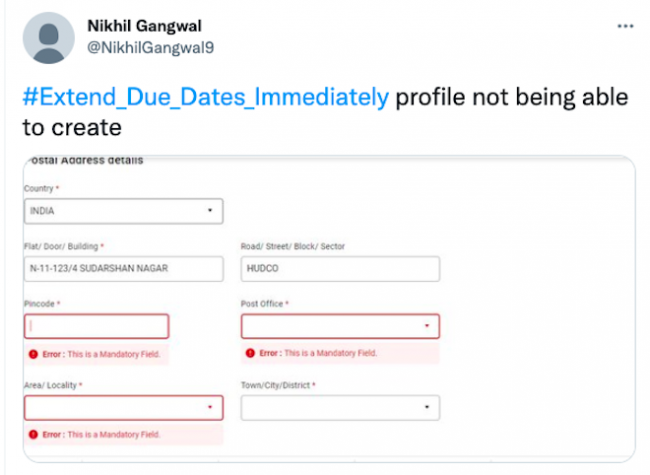

Users complained like this

One user complained and wrote, “Correct the difficulties faced in online filing… Last name is neither automatic nor allowed to be entered in ITR-3. So online verification and submission of ITR is not possible? So what to do?” Responding to the user’s complaint, the official Twitter handle of the Income Tax Department said, “Please share the details of the case (with PAN and your mobile number) with us at orm@cpc.incometax.gov.in. Our team will contact you. We would also request you not to share personal details like PAN on social media so that it is not misused.”

Similarly, another user has complained that the tax filing portal https://eportal.incometax.gov.in is not working properly. It is taking time, loading continuously then failing. One user complained, “@IncomeTaxIndia Since this morning it is only showing loading. Please let me know when it works properly.”

Deadline was extended last year Let us inform that in view of the difficulties being faced by the taxpayers due to the Kovid epidemic and the failure of the filing website, the government had extended the last dates last year. Meanwhile, the tax department today tweeted, “Dear taxpayers, remember if you have not filed your ITR yet.

The due date for filing ITR for AY 2022-23 is July 31, 2022. Salaried employees and HUFs (Hindu Undivided Families), whose accounts are not required to be audited, are required to file their income tax returns for the financial year 2021-2022 by 31 July 2022.