Today is the last day of the year 2024 and the new year (New Year 2025) is going to start from tomorrow, meanwhile big news has come for the taxpayers. Actually, the Income Tax Department has increased the deadline of Vivad Se Vishwas Scheme at the last moment.

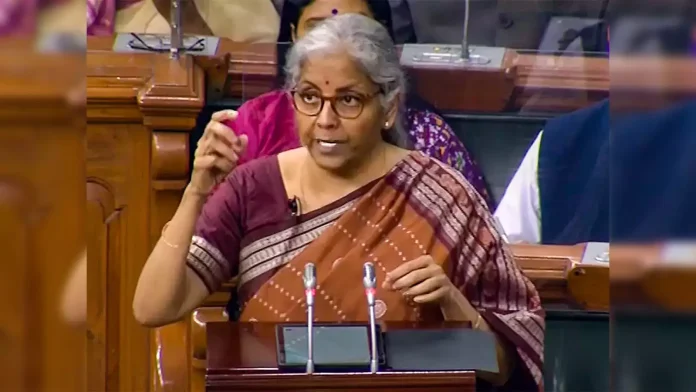

The last date of this scheme was fixed as 31 December, which has now been extended to 31 January. This means that for one more month taxpayers can settle their disputed tax with less amount. Let us tell you that this scheme was announced by the Finance Minister in the first budget of Modi 3.0. Let us know about it in detail…

Deadline extended for one month

The Income Tax Department had started the Vivaad se Vishwas scheme to settle the disputed tax issues of taxpayers, in which taxpayers troubled by income tax disputes can get it done by paying a small amount. The deadline of this scheme was also going to end on 31 December 2024 i.e. today. But on Monday itself, the Income Tax Department issued a notification in this regard and announced to extend its deadline for 1 month. If you want to settle the tax dispute by taking advantage of this scheme, then you now have time till 31 January 2025.

Otherwise, you will have to pay 110% payment

The Central Direct Tax Commission (CBDT) has issued a notification saying that now the benefit of Vivaad se Vishwas scheme will be available next year as well and disputed tax settlements can be done till January 31. It has been clearly stated that if taxpayers are unable to settle their disputes by the new deadline, then in such a situation, 110% payment of the disputed tax demand will have to be made on the declarations made on or after February 1, 2025.

These taxpayers will get the benefit of the scheme

Vivad Se Vishwas Yojna will be available to such taxpayers whose petition has been filed in relation to the disputed tax related matter. Taxpayers who have filed a petition in the Supreme Court, High Court or Income Tax Appellate Tribunal till July 22, 2024, or have been appealed by the tax officers, then they can get the benefit of settling the tax by paying a lesser amount under this scheme.

The government hopes that this scheme will resolve about 2.7 crore direct tax demands, the total amount of which will be about Rs 35 lakh crore. Four types of forms have been issued under this scheme of the Income Tax Department, which was started to settle these cases quickly.

These four forms have been issued

- Form 1 – In this you will file the declaration and give the undertaking.

- Form 2 – This will be for the certificate to be issued by the authority.

- Form 3 – Under this form, the declarant will give information about the payment.

- Form 4 – The authority will give information about the full and final settlement of the tax arrears.

Form 1 and 3 are the most important.

In the Vivaad se Vishwas Sarkari scheme, Form-1 has to be filled separately for every dispute related to income tax. Whereas in Form-3, you will have to share the payment information. In this, you will have to give it to the authority along with the proof of appeal, objection, application, writ petition or withdrawal of the claim. Form 1 and 3 can be submitted electronically by the taxpayers. These forms will be made available on the e-filing portal of the Income Tax Department i.e. www.incometax.gov.in.

What is direct and indirect tax?

In India, income tax comes under direct tax. People who fall under the prescribed range for this have to pay tax according to their income bracket and file income tax return (ITR). Indirect tax includes cases of goods and services tax i.e. GST. Whatever goods you buy or use any service like telecom, you have to pay GST on it.

Related Articles:-

- OTS Scheme: These Electricity Consumers will not get the Benefit of OTS scheme – uppcl.org

- LPG Cylinder Price: Rs 250 Cheap Composite LPG Gas Cylinder – Check Details

- UPI Payment System: UPI rules to change from January 1, money transfer limit will be doubled

- Schools Closed: All schools suddenly closed before winter vacations, this is the reason…

- LPG, PF, UPI and… Big changes are going to be implemented from January 1, know in detail