Income Tax Return Update: Citizens above the age of 75 years are not required to file ITR. However, there are also some conditions for this, only after fulfilling which they get exemption. If they do not file ITR without fulfilling these conditions, they can be fined.

It is mandatory for almost every person earning income to file ITR. However, in some cases the government has given its exemption. Filing of ITR is not mandatory for many senior citizens. But who are these senior citizens who are exempted from filing ITR? Actually, senior citizens are not required to file ITR after the age of 75 years.

However, this is possible only if the source of their income is pension and interest from hard earned money deposited in the bank. The government had given this exemption to people above the age of 75 years in 2021 under a new rule. A new section 194P was inserted in the Income Tax Act, 1961 under the Finance Act 2021, under which senior citizens above 75 years of age, who receive pension and interest from bank deposits, are exempted from filing ITR. Finance Minister announced this Nirmala Sitharaman was did.

What are the other conditions

To get exemption from filing ITR, a citizen who is above 75 years has to fill Form 12BBA and submit it to the bank. In this form, you will have to give details of earning from pension and interest on FD. The tax mentioned in the form has to be deposited in the bank. On submission of tax, ITR will be deemed to have been filled and no separate ITR will be required to be filed. However, there is also a big condition here that the FD account and pension account of the citizen should be in the same bank, only then he will get this exemption. Apart from this, even if the interest on FD is taxable, you will not get exemption from returns. If you are above 75 years of age but do not fulfill the above conditions then you have to file ITR. Failure to do so may result in fines.

31st July is the last date to file ITR

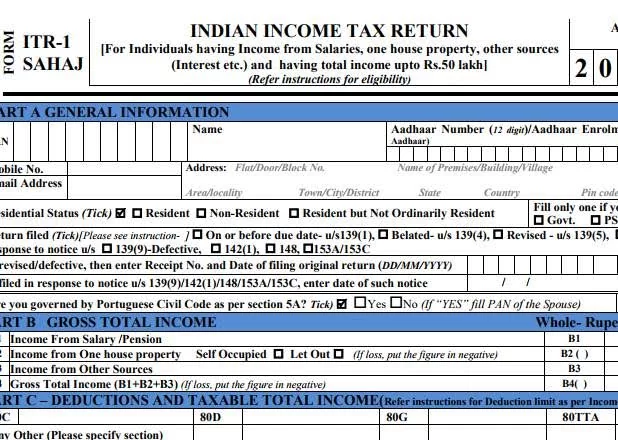

The last date for filing ITR for the financial year 2021-22 and the year under review is July 31, 2022. This date for those people whose annual income from business, job or any other source is up to Rs 50 lakh. There itself. If audit is necessary for a business, then the last date for filing ITR for its owner is 31 October 2022.