UPI Update: In a recent NPCI circular, it has been said that as per RBI’s directive for the use of RuPay credit card on Unified Payments Interface (UPI), no fee will be charged for transactions up to Rs 2,000. Will go

RuPay Credit Card is operational for the last four years, and is linked to all major bank and is issuing incremental cards for both commercial and retail sectors. “During credit card on-boarding on the Apps, device binding and UPI PIN setting process shall be included as customer consent to enable the credit card for all types of transactions,” the circular issued on October 4 said. will be considered.’

The National Payments Corporation of India (NPCI) said in the circular that the existing process of the app to enable international transactions will be applicable to credit cards as well. It is noted that Nil Merchant Discount Rate (MDR) for this category will be applicable up to transaction amount less than and equal to Rs.2,000.

MDR is the cost paid by a merchant to a bank for accepting payments from its customers via credit or debit cards, whenever the card is used for payment in their stores. The merchant discount rate is expressed as a percentage of the transaction amount. It was informed that this circular is in force from the date of issue and members are requested to take note of the contents of this circular and bring it to the notice of the concerned stakeholders.

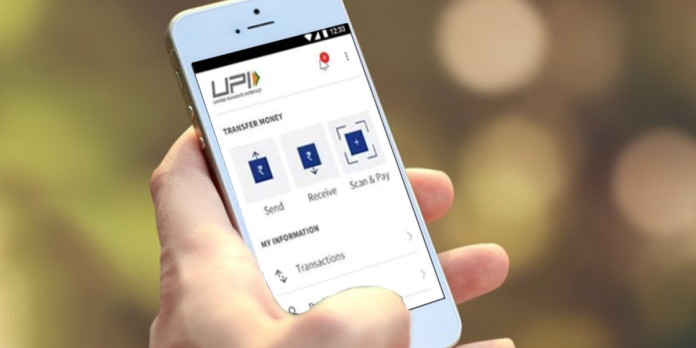

As per the circular, the UPI app will ensure complete transparency on the transactions made by the customer using the credit card through easily accessible transaction history and clearly visible user interface while making the payment.