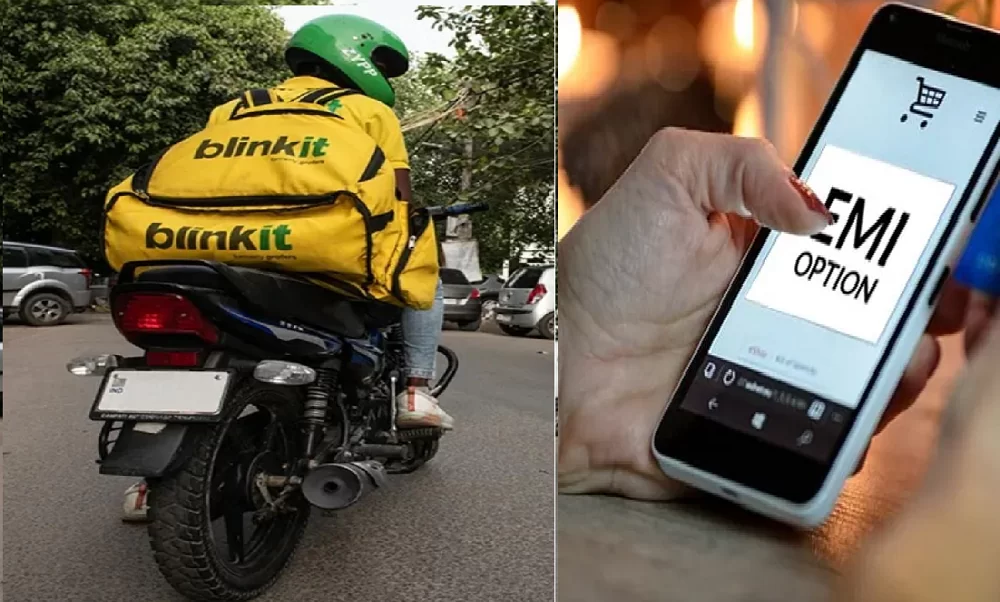

Blinkit has introduced EMI option for orders above Rs 2999. This does not include orders containing gold and silver coins. The move is aimed at improving financial planning of people:

Quick e-commerce company Blinkit has started EMI option for orders above Rs 2999. The aim of this move by Blinkit is to increase the purchasing power of customers and help them improve their financial planning. Blinkit founder Albinder Dhindsa has posted on social media that we have started shopping with EMI on Blinkit. The new EMI service will be applicable on all orders above Rs 2,999. This does not include orders containing gold and silver coins.

How to avail Blinkit EMI option

This EMI option will be applicable on all orders above Rs 2,999. Only customers who have credit cards of these banks can avail the EMI option of Blinkit.

HDFC Bank Credit Card EMI starts at 16% per annum with a processing charge of Rs 199.

SBI Bank credit card EMI starts at 15% per annum with a processing fee of Rs 99. ICICI Bank credit card EMI starts at 15.99% per annum with a processing fee of Rs 199.

Kotak Mahindra Bank credit card EMI starts at 16% per annum with a processing fee of Rs 199. Axis Bank credit card EMI starts at 16% per annum with a processing fee of 1%.

RBL Bank credit card EMI starts at 13% per annum with a processing fee of Rs 199. CITI Bank credit card EMI starts at 16% per annum with a processing fee of 1%.

We have introduced buying with EMI on Blinkit!

EMI options will be applicable on all orders above ₹2,999 (except orders that contain gold and silver coins)

We believe this will improve affordability and enable better financial planning for our customers. pic.twitter.com/htBrxnKMjk

— Albinder Dhindsa (@albinder) October 24, 2024

Choose EMI option like this

Step 1: Add the items you need to the cart.

Step 2: After this, search and select the EMI option on the checkout page. Note that you will be able to avail this EMI service only if the price of the items in your cart is more than Rs 2999. After the order is delivered, the bank will process your EMI within 3 to 5 days.

Related Articles:-

Aadhaar card not an authoritative proof of date of birth: Supreme Court

EPFO: Govt may hike VPF tax-free interest limit soon, know the details

New Update Paytm users, Before making UPI payment, do this work from your bank account immediately