New Delhi: According to the Income Tax Department, taxpayers who fail to file tax returns before the due date of ITR filing for the financial year 2022-23, 31 July 2023, will have to pay a penalty. Belated ITR can be filed by paying penalty as per rules. The penalty will be decided according to the annual income of the taxpayers.

For the current financial year till July 31, 2023, 6.77 crore taxpayers have filed income tax returns, but those who have missed, the Income Tax Department has given the option to file belated ITR. Under Section 139 (5) of the Income Tax Act 1961, taxpayers have been given the facility to file belated ITR. Taxpayers have been given a chance till 31 December 2023.

What is the penalty for belated ITR?

Taxpayers will have to pay late fine or penalty for filing belated ITR as per income tax rules. Filing of belated ITR is charged from the prescribed fine taxpayers under section 234F of the Income Tax Act, 1961. A fine of Rs 1,000 has to be paid for small taxpayers who file belated ITR, i.e. those with an annual income of less than Rs 5 lakh. On the other hand, those whose income is more than Rs 5 lakh will have to pay Rs 5,000 as penalty, after which belated ITR can be filed.

Income tax told two ways to deposit penalty

Taxpayers have to deposit applicable late fine or penalty before filing belated ITR. Late fee/penalty for filing belated ITR is paid using Challan No. 280.

Taxpayers can submit the payment of belated penalty online on the website of NSDL.

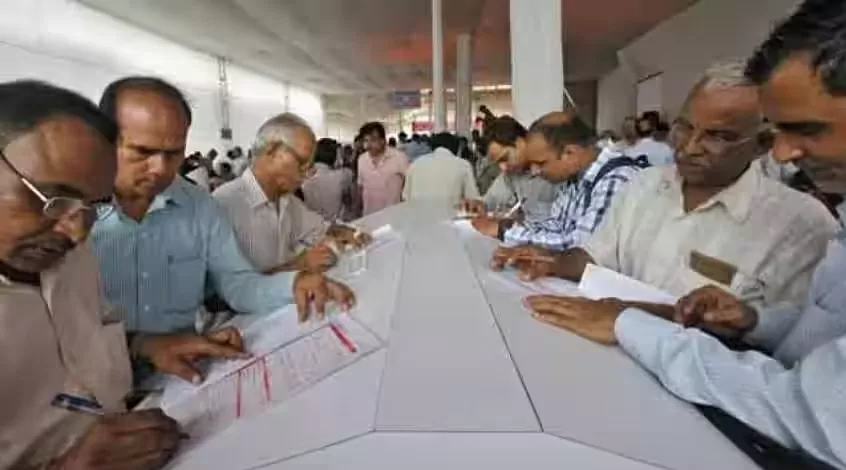

Taxpayers can also deposit the late fine by visiting the nearest bank branch.