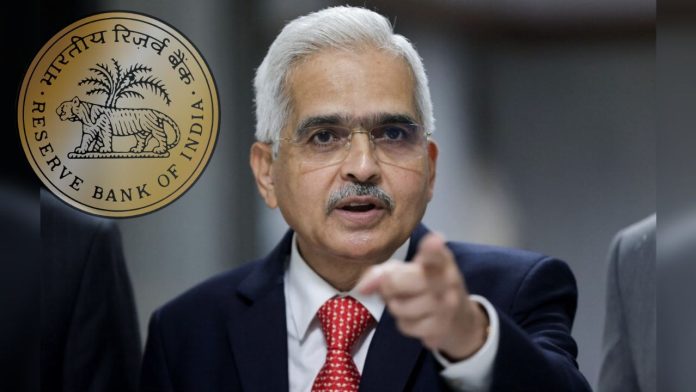

Cooperative Banks License: Strict steps are being taken continuously against the banks for not following the rules from the Reserve Bank of India (RBI).

After imposing penalty on HDFC and HSBC Bank in the past, RBI has now canceled the licenses of two cooperative banks operating in Maharashtra and Karnataka. Also, both the banks have been asked not to do any kind of banking business after the cancellation of the license on July 5, 2023.

Will not be able to accept any type of deposit

It was informed by the RBI that the banking licenses of Buldhana-based Malkapur Urban Co-operative Bank Ltd. and Bengaluru-based Sushruti Souharda Sahakar Bank Regular (Shushruti Souharda Sahakara Bank Niyamita) have been cancelled. According to the statement, after the closure of the business, both the banks will not be able to accept any kind of deposits nor will they be able to give deposits to the customers.

What will happen to those who deposit money?

This step has been taken by the central bank in view of the lack of adequate capital and earning potential of both the cooperative banks. The Reserve Bank has asked the Cooperative Commissioner and Registrar of Cooperative Societies, Maharashtra to issue an order for winding up the bank and appoint a liquidator for the bank. The Reserve Bank said that every depositor will be entitled to receive the deposit insurance claim amount of his deposit up to a limit of five lakh rupees from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

According to the data presented by the bank, 97.60% of the depositors are entitled to receive the full amount of their deposits from DICGC. RBI said that if Malkapur Urban Cooperative Bank is allowed to carry on banking business, it will affect public interest. In the coming times, the bank will be unable to make full payments to its depositors with the current financial condition.