New Delhi: A certain number of free transactions are allowed at ATMs every month by all important banks, both public and private. At the same time, your account type and the debit card you use also make a difference. Know whether the number of free transactions at ATMs of those cards is different.

Charges are levied for using ATMs more than the permitted number of free monthly transactions. According to RBI in June last year, banks were allowed to charge ₹21 per transaction at ATMs in excess of the monthly free transaction limit with effect from January 1, 2022. Earlier, banks could charge 20 for each such transaction.

Customers are allowed five free transactions every month and there is a limit of only three free transactions for withdrawing money from other bank ATMs. Customers in non-metro centers can avail up to five free transactions at other bank’s ATMs.

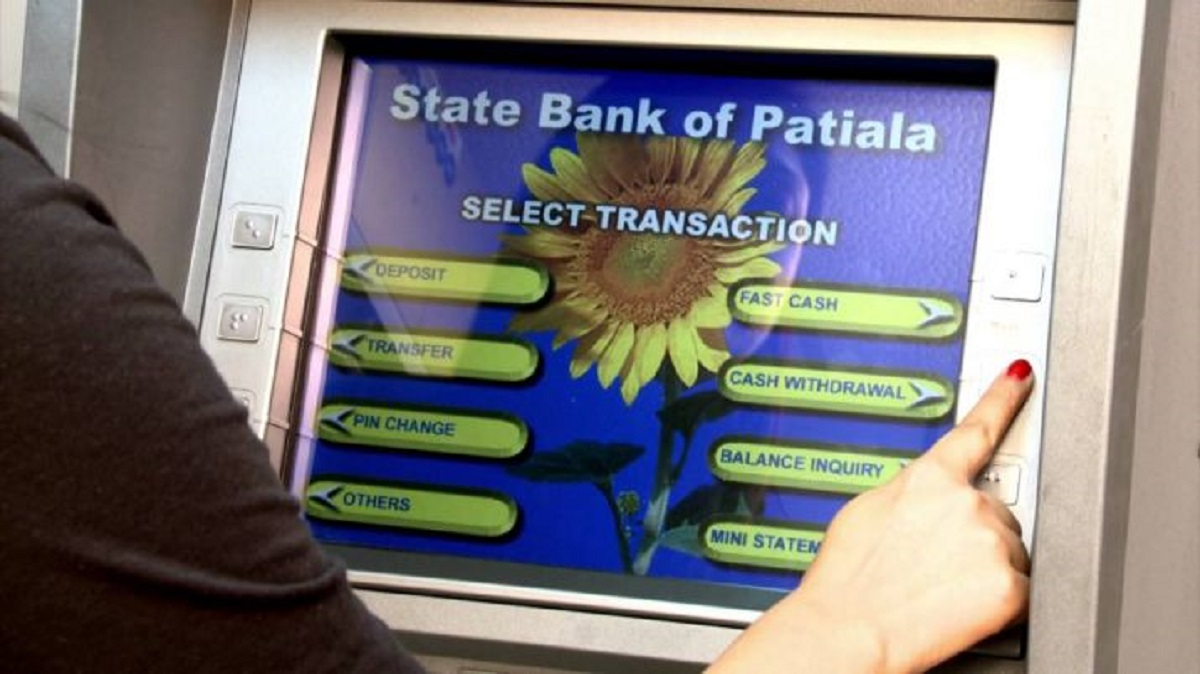

Below is the information about all the big banks…

State Bank of India

SBI one of the top commercial banks in India offers three free ATM withdrawals in metro cities and five in rest areas. Thereafter, there is a fee of Rs 5 for transactions and Rs 10 for withdrawals from non-SBI ATMs.

Punjab National Bank

PNB offers three free ATM withdrawals in major cities and five free withdrawals in most other locations similar to SBI. After that the bank charges Rs 10 on ATM withdrawals.

HDFC Bank

In India, HDFC Bank offers five free transactions in total and three free transactions in important cities. The bank charges Rs 125 for international ATM transactions.

ICICI Bank

ICICI Bank follows the same rules 3 and 5 as other banks in terms of free withdrawals. Withdrawals from ATMs are subject to additional bank charges of Rs 21.

Axis Bank

Axis Bank also has the same formula 3 and 5 provides the rule. After that, the bank charges a 21% withdrawal fee.