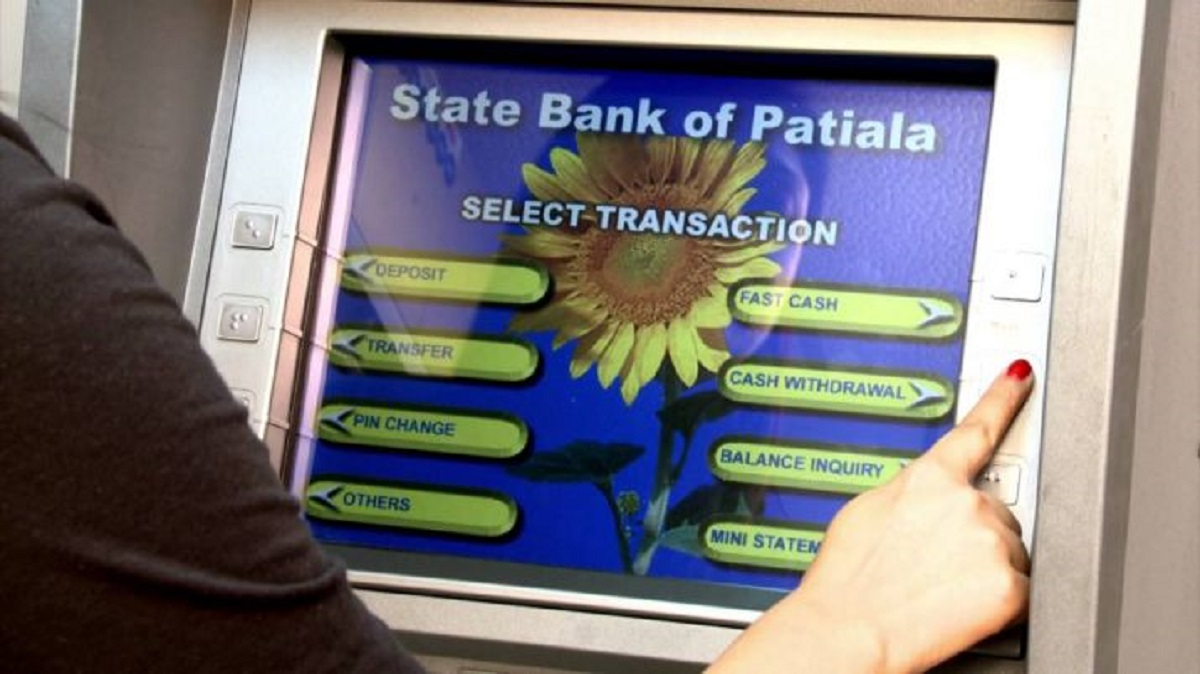

SBI ATM Withdrawal Rule Changed: If your account is in SBI, then there is important news for you. Actually the bank has changed the rules regarding withdrawing cash from ATMs.

Now you will need a special number to withdraw cash from SBI ATM. If you do not enter this number, you will not be able to withdraw money. Let’s know.

The bank informed that now OTP will be required to withdraw money from ATM. If you do not have OTP then you will not be able to withdraw money. This OTP will come on the mobile number registered with your bank.

Is this the new rule?

The bank has implemented this new rule to avoid fraud. In this, when you withdraw more than Rs 10000 from an ATM, you will have to enter an OTP sent to the mobile number registered with the bank account.

Here is the whole process

Every time you will need OTP to withdraw cash above 10000 thousand, without this you will not be able to withdraw money.

This OTP will be a 4-digit number, which will be used only once for withdrawing money.

In this, you will enter your ATM PIN and after that you will enter the amount. Now when you proceed, you will be asked to enter OTP.

Now when you enter the OTP, your cash will come out.

That’s why the bank took this step

The bank has taken this step to prevent fraud. SBI has the largest network of 22,224 branches and 63,906 ATMs/CDMs in India with 71,705 BC outlets. At the same time, the number of customers using internet banking and mobile banking service is around 91 million and 20 million.