ATM Cash Withdrawal: One time transaction can be done with one OTP. It is a means of verification of the customer. With this, the same person will be able to withdraw money from the ATM whose OTP will be sent to his mobile. The OTP will be sent to the mobile of the person who has an account with SBI.

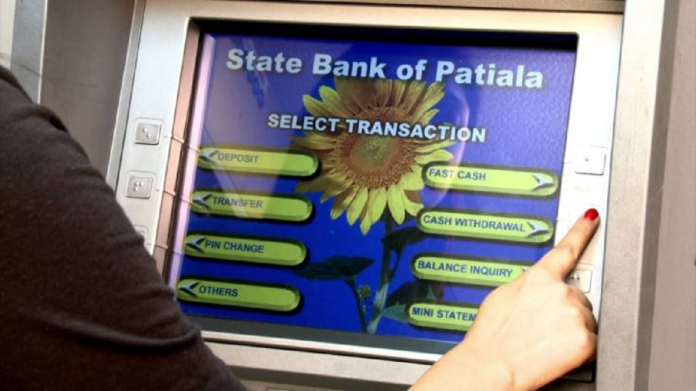

State Bank of India (SBI) has made a new rule for withdrawing money from ATMs. Now SBI customers will also have to enter one time password i.e. OTP while withdrawing money from ATM. This facility is being provided 24 hours and 7 days. This facility is being given in every SBI bank ATM for transactions above Rs 10,000.

In view of the incidents of fraud, SBI has made cash withdrawal from ATMs more secure. In view of this, OTP is sent to the customer’s mobile. Then the same OTP has to be entered in the ATM. The name of this new service is OTP based cash withdrawal facility. OTP is received on whatever mobile number of the customer is entered in the bank.

One time transaction can be done with one OTP. It is a means of verification of the customer. With this, the same person will be able to withdraw money from the ATM whose OTP will be sent to his mobile. And the OTP will go to the mobile of the same person who has an account in SBI. State Bank has described OTP based cash withdrawal as a vaccination against fraud people. SBI says that protecting customers from fraud is its priority.

Also know how to withdraw money from OTP. Actually, when a customer puts a debit card in an ATM, then an OTP comes on his mobile phone. The customer has to first enter this OTP at the ATM. Only after that the process of cash withdrawal will start. Therefore, if you are a customer of SBI and are going to withdraw money from SBI ATM, then do not forget to take mobile phone along with you.

The OTP sent to your mobile is a 4 digit number. This OTP tells that the customer is correct as it is sent to the registered number. OTP is being used in the transaction for authentication or rather for verification. Nowadays OTP has been implemented in almost every banking service so that fraud can be got rid of. Fraudsters will not be able to withdraw cash from OTP based ATMs.

For OTP based cash withdrawal, if the customer wants to withdraw more than Rs 10,000, then he has to enter the OTP. Apart from this, the customer will also have to enter the PIN number of the debit card. This gives double security in ATM withdrawal. First OTP and then Debit Card PIN. Then money can be withdrawn from ATM.