You will be happy to know that you can get a personal loan of up to Rs 2 lakh using your Aadhaar card. To avail this loan, one can also take help from banks and government schemes.

Sometimes situations arise in life when money is suddenly needed, such as a health emergency or money for education. At such times, it becomes necessary to manage money.

To get a loan from a bank, we often have to follow various documents and rules. If you are also in such a situation, then there is nothing to worry about now. You will be happy to know that you can get a personal loan of up to Rs 2 lakh using your Aadhaar card. To get this loan, one can also take the help of banks and government schemes. Now getting a personal loan has become easy with the help of Aadhaar card.

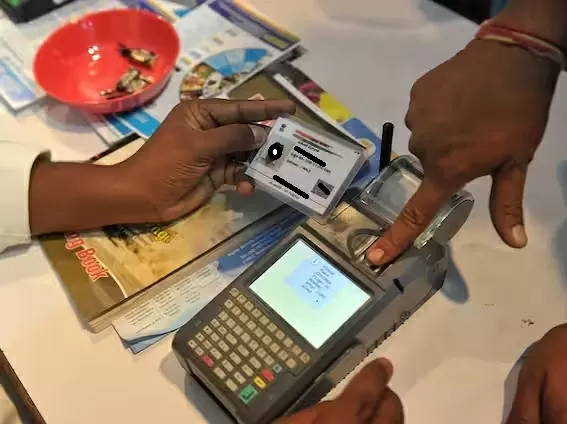

Aadhaar card has become an important document for Indian citizens in today’s time. Now Aadhaar card is necessary for every work, be it opening a bank account, making a PAN card or for proof of address, Aadhaar card is used everywhere. Now Aadhaar card can be used not only as proof of identity and address but also for personal loans. If you need money in an emergency, then you can take a personal loan of up to Rs 2 lakh with the help of your Aadhaar card.

Advantages of taking a loan on Aadhaar card

Simple documents: Aadhaar card loans are different from normal loans as they do not require much documentation. Like proof of income, proof of address and proof of identity, only Aadhaar card is used instead. Aadhaar card verifies both identity and address, which reduces paperwork.

Digital Process: These loans are available online and the entire process is digital. This ensures faster approval and eliminates manual work, thus the loan amount is disbursed to the account quickly.

Faster process : These loans get approved quickly due to the digital application process. This saves you time and you can get the money easily.

Who can take a loan?

Age: To apply for this, your age should be between 21 and 60 years. He should be a citizen of India.

Credit Score : If your credit score is 650-700 or above, it becomes easier to get a loan and you can get lower interest rates.

Valid Aadhaar Card: Aadhaar card should be active and linked to the applicant’s mobile number for verification.

Employment status: You must be a salaried employee or self-employed person.

How to Apply

Apply Online: To apply for a loan, visit the lender’s (bank or NBFC company) website or download their mobile app.

Check eligibility: Check the eligibility criteria for the loan. You can check your eligibility using the lender’s calculator.

Upload Documents: Upload your Aadhaar card, PAN card and income proof for verification. To enable OTP based verification, make sure your Aadhaar card is linked to the mobile number.

Approval and Fund Transfer : The loan is approved after submitting the documents. Disbursement of the amount will usually be credited to your account within 24 to 48 hours.

Keep these things in mind before taking a loan:

Take a reliable bank loan only from a reliable bank or NBFC.

Interest rates: Personal loans are given without any collateral, so their interest rates depend on your credit score, income, credit history, and other factors. Before taking out a loan, compare interest rates from different lenders.

Processing Fees: Know about processing fees and other charges in advance to avoid any unexpected expenses at the last minute.

Manage EMIs: Understand your repayment capacity and ensure you are able to pay your EMIs on time.

Impact on credit score : Paying off your loan on time can improve your credit score, while defaulting or not paying can damage your credit standing. Therefore, take out a loan only when it is truly necessary.

Related Articles:-

- EPFO has simplified the rules for those changing jobs, now you will not have to do this…

- H1B Visa Final Rule: Final rule for H-1B work visa for Indian professionals implemented, Major key changes

- Indian’s Hydrogen train: Country’s first hydrogen train will run between these 2 cities of India

- TRAI New Rule: Jio, Airtel, Vi and BSNL SIMs will remain active even without recharge…

- School Reopen: Schools will open here from Today, strict restrictions on timing. key Details Inside