RBI On Repo Rate: The general public may once again get a major setback. The RBI Bulletin states that the process of controlling inflation will go slowly and the RBI has also ruled out not increasing the repo rate.

The general public, troubled by rising inflation in the country, may once again get a major setback. The Reserve Bank of India (RBI) issues its bulletin every month. This month’s bulletin has been issued, seeing that it is being speculated that the central bank will continue to take a tough stand to bring inflation under control.

RBI issues monthly bulletin

RBI released its Monthly Bulletin on 17 October. Let us tell you that this year the Reserve Bank has increased the repo rate 4 times so far to control inflation. It has been said in this bulletin that the focus of monetary policy will be on bringing inflation under control and bringing it within the prescribed limit.

Big thing said in RBI’s bulletin

The report ‘State of the Economy’ included in the bulletin states that it takes some time to see the effect of the steps taken under the monetary policy. If retail inflation has remained above the RBI’s target for three consecutive quarters, the process of fixing its responsibility will start. The central bank will take more stringent measures to control inflation.

Writers gave their views

In the RBI bulletin, it has been said that apart from the corona epidemic, geopolitical factors have also played an important role in increasing inflation. Let us tell you that Michael Patra, Deputy Governor of RBI and member of the Monetary Policy Committee, is a co-author of this report.

However, the views expressed in this report are those of the authors and do not constitute the views of the Reserve Bank of India. The Reserve Bank of India expects that retail inflation will come down to 6.7 percent in the financial year 2022-23, while it may come down to 5 percent during April-June in the year 2024.

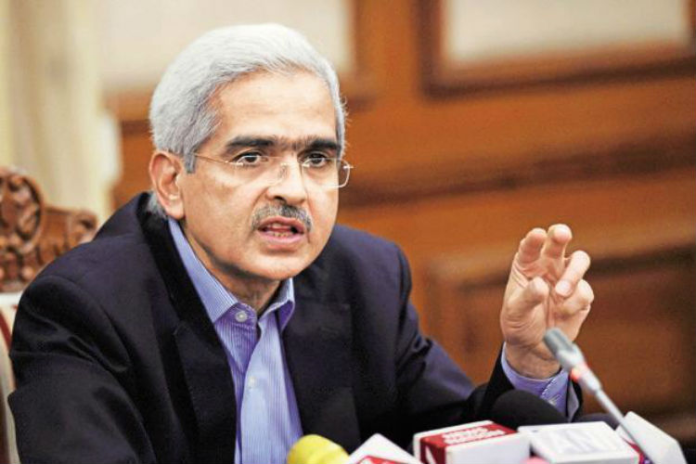

Let us tell you that the Governor of Reserve Bank of India, Shaktikanta Das has expressed the expectation of it to come down to 4 percent in two years.