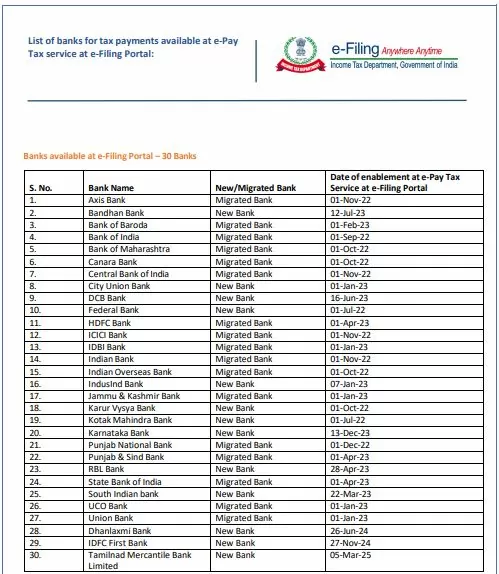

New Delhi. The Income Tax Department has updated the list of banks under e-Pay Tax Service on the e-filing portal to increase the convenience of taxpayers. Now 30 banks have been authorized under this facility. This change will make the tax payment process easier and more convenient. If your bank is not in the list of authorized banks, then you can pay tax using NEFT/RTGS or payment gateway.

E-Filing means completing the entire process of filing tax returns online. For this, taxpayers need PAN-based login credentials. This facility is available on the official website of the Income Tax Department, where it can be used in both pre-login and post-login modes.

You can pay tax from these banks.

If you want to pay tax online through e-Filing Portal, then only authorized banks will be available for this facility. These are the banks..

What to do if your bank is not in the list?

If your bank is not in the authorized list of e-Filing Portal, then you can use NEFT/RTGS or payment gateway. Currently, Bank of Maharashtra, Canara Bank, Federal Bank, State Bank of India, HDFC Bank and Kotak Bank are providing this facility. To use the e-Pay Tax facility on e-Filing Portal, it is necessary to generate Challan (CRN). Each challan will have a unique Challan Reference Number (CRN), through which the payment can be tracked.

- New Pension Scheme: Govt’s new scheme for central government employees, good news will be available from April 1

- 7th Pay Commission: Good news for Employees..! DA hike likely to be announced this week, Check Details

- EPFO is making a big change, PF account will be identified by Aadhaar

- TDS Deduction: If more TDS is being deducted on your income, then fill Form-13 to avoid the deduction

- Post Office’s Time Deposit Scheme Gives Bumper Returns, You Can Open an Account With ₹ 1000