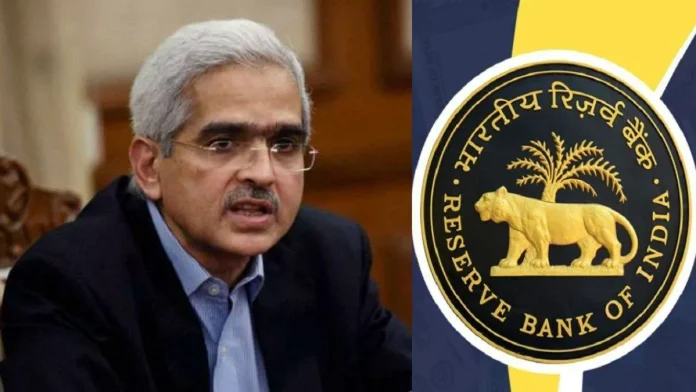

Credit Line on UPI: With the aim of increasing economic activities, the Reserve Bank of India has now allowed Small Finance Banks to give loans.

With this decision of RBI, small entrepreneurs and businessmen in villages and towns will also get the facility of loans at affordable interest rates.

New customers will start joining the bank

This is good news for small finance banks and getting loans through UPI (Credit Line on UPI) will open new business avenues for these banks. Many small finance banks (SFBs) like AU Bank have already started giving loans through credit cards. Now new customers will also start joining the banks with this easy method.

Now there is no problem in getting financial help

Loan facility will reach more and more people through UPI. This also makes the transaction between bank and customer very easy. Along with promoting economic development, those deprived communities of the society also get the facility of financial assistance when needed. In such a situation, due to this facility, they will no longer have any problem in starting their work or business on a small scale, which will open new avenues of economic development along with financial activities in the market. New employment opportunities will open up.

These businessmen will get a lot of help

Small Finance Banks in India are a category of banks that have been created to provide basic banking services to small businessmen, small and cottage industries. These banks are governed by the Reserve Bank of India (RBI) under the Banking Regulation Act, 1949. They receive licenses from RBI.

Related Articles:-

8th Pay Commission: Minimum basic salary to rise to Rs 34,500 – Details inside