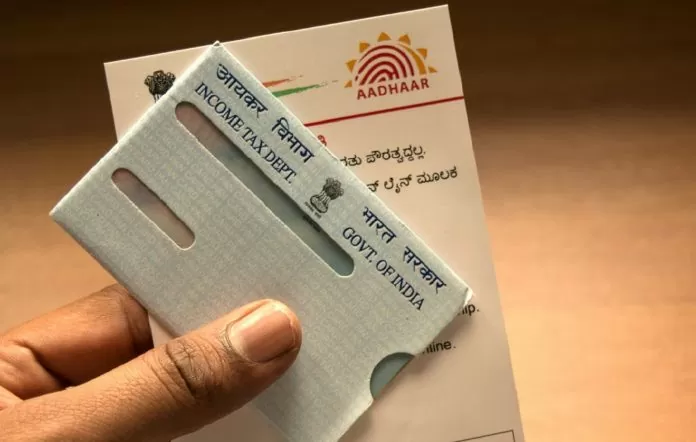

Aadhaar-Pan Linking: Linking PAN card with Aadhaar was already made mandatory by the Government of India. The government had made it clear that if you do not link PAN card with Aadhaar, then your PAN card will become inactive or useless.

The deadline for linking PAN with Aadhaar was already set by the Government of India, and this deadline ended on June 30, 2023. After this, PAN cards which were not linked to Aadhaar became inactive and defaulters started being fined.

After the deadline, you will have to pay a fine

Let us tell you that earlier the Government of India had kept the process of linking PAN with Aadhaar absolutely free, but after the last deadline is over, now a fee or fine of Rs 1,000 will have to be paid to link the two documents. Under this policy of 2023, more than 2 crore taxpayers have linked PAN with Aadhaar after the free deadline is over.

In February 2023, Minister of State for Finance Pankaj Chaudhary informed the Parliament that as of January 29, 2024, there were about 11.48 crore PANs which were not yet linked to Aadhaar. Due to this, the government recovered a fine of about Rs 600 crore. Under Section 139AA of the Income Tax Act, 1961, it is mandatory for every taxpayer to link PAN with Aadhaar, otherwise they cannot file income tax returns.

Let us tell you that the Income Tax Department had declared the last date for PAN-Aadhaar linking as March 31, 2022, but it was later extended to June 30, 2023. Those who have not linked Aadhaar and PAN even after July 1, 2023, will have to pay a fine of Rs 1,000 to get it linked.

How to link Aadhaar with PAN

The process of linking PAN to Aadhaar by paying the fine can be done through the e-filing portal of the Income Tax Department. First of all, go to the portal and click on ‘Link Aadhaar’ and enter the PAN and Aadhaar number. After this, make the payment through ‘e-pay tax’ and confirm it by entering the OTP. On completion of the payment, the challan will be generated and PAN-Aadhaar can be linked through the e-filing portal.

How to link PAN and Aadhaar online

- Visit the e-filing portal and click on ‘Link Aadhaar’ from the Quick Links section of the homepage.

- Enter your PAN and Aadhaar number.

- Click on ‘Continue payment through e-Pay Tax’.

- Enter your PAN number and confirm it. You will be sent an OTP on your registered mobile number.

- After OTP verification, e-Pay Tax page will appear on your screen.

- Click on ‘Proceed’ Income Tax button and select the relevant Assessment Year and type of payment (Other Receipts – 500).

- After paying the late fee, Aadhaar can be linked to PAN.

- The status of PAN-Aadhaar linking can be checked by clicking on ‘Aadhaar Status’ available on the homepage of the e-filing portal.

Related Articles:-

IMD has issued a red alert for these states, heavy rain will occur in the next 24 hours

PAN 2.0 with QR code: Apply for PAN 2.0, it will be delivered on email, know the easy way