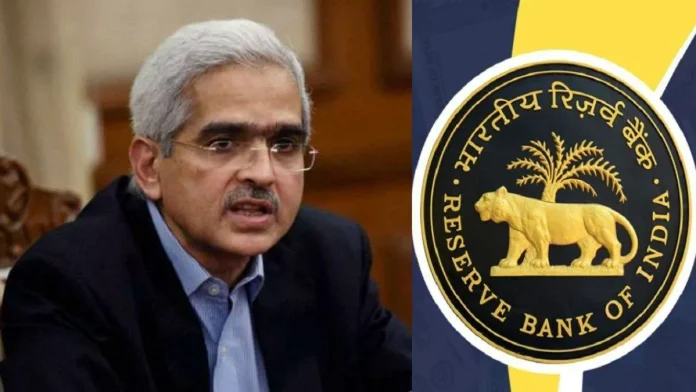

The Reserve Bank has not increased the repo rate. The central bank announced the monetary policy on August 8. In this, it said that the Monetary Policy Committee has announced not to increase the repo rate.

This means that at present the EMI of home loan customers will not decrease. RBI’s monetary policy is as expected. Analysts had said that there is no hope of reduction in interest rates in the August monetary policy.

Home loan EMI will not decrease for now

The repo rate not decreasing in RBI ‘s monetary policy means that loans are not going to get cheaper at the moment. Apart from this, the EMI of customers who have already taken home loans is also not going to decrease. They will have to wait for the reduction in EMI. The central bank has not made any change in the repo rate for more than a year. Experts say that home loan customers will have to wait at least till the end of this year for a reduction in interest rates.

Also Read: Railways’ big decision to prevent rail accidents, know when will work on it start?

Customers can talk to the bank for concession in interest rates

Home loan customers whose interest rates are high can negotiate with their bank for a concession in the interest rate. If your bank agrees to give relief, then you do not need to transfer your loan to another bank. If your bank is not ready to give concession, then you can think about transferring your loan to another bank. But, it must be kept in mind that the cost of loan transfer should not be high.

Should I postpone my plan to take a home loan right now?

Experts say that people who are planning to take a home loan to buy a house have two options. First, they can wait for a few months. Interest rates are expected to decrease in India by the end of this year. The reason for this is that in America too, the pressure on the central bank to reduce interest rates has increased. If the interest rate decreases in America, it will also affect the RBI. If you are getting property at a very good price, then you should not wait for the interest rate to decrease. The reason for this is that later if the price of the property increases, you may suffer a loss despite the low interest rate.