New Delhi: Only after the implementation of the recommendation of the Pay Commission, the arrears of salary and other allowances are paid to the central employees with retrospective effect. At present, Central employees and pensioners are getting salary and pension based on the recommendation of 7th Pay Commission.

In the current financial year also, due to the increase in Dearness Allowance (DA), the salary and pension amount of central employees were increased. After this hike is implemented from the pre-effective date, the arrears along with salary and pension are paid. In such a situation, changes in the tax slab are also bound to happen. In such a situation, tax relief can also be given on the payment of the outstanding amount. Come, let us know how to get relief from tax on payment of dues…?

how to get relief

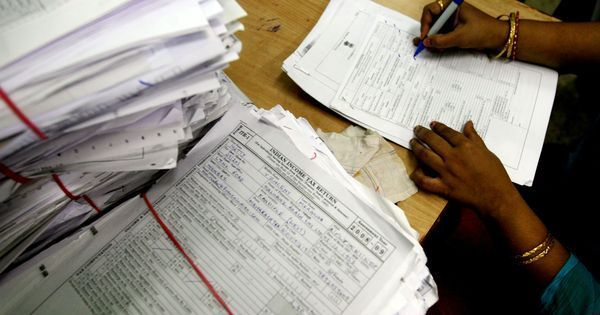

However, Central Government employees who have received arrears of salary can claim relief under section 89 of the Income Tax Act. Under section 89(1) of the Income Tax Act, one can claim tax relief for receiving salary in a prescribed arrears or advance or family pension in arrears.

To claim relief, government employees will have to fill Form 10E online on the Income Tax e-filing portal. Taxpayers claiming relief under section 89 without submitting Form 10E are likely to get a notice from the Income Tax Department. After submitting Form 10E, it is also mandatory to mention the details under Tax Relief column in your ITR filing to get refund.

How to File 10E Form

-

- Central employees can file 10E form through the official portal of Income Tax Department to get relief from tax on payment of dues.

- For this, first you have to login to the official portal of Income Tax Department http://www.incometax.gov.in.

- After login, you have to click on the e-file tab.

- After this select Tax Exemption and Reliefs/Form 10E in the list of forms

- Select the assessment year and click on it.

- Form 10E has 5 annexures for different types of arrears.

- You should select Annexure-I, which is for advance or arrears of salary.

- Form 10E will automatically calculate the amount of tax relief available under section 89.

- Once you have filed Form 10E, you must claim it in your Income Tax Return (ITR) filing to receive the money.

- Mention these details under the Tax Relief column in your ITR.

8th pay commission will not be formed In early August, Minister of State for Finance Pankaj Choudhary informed the Lok Sabha that the Center was not considering setting up an 8th Pay Commission for central government employees. In a written reply to a question, he said that no such proposal is under consideration with the government for the formation of the 8th Central Pay Commission for the Central Government employees. It can be implemented on 1 January 2026.