RBI Rules On Negative Balance :Reserve Bank of India i.e. RBI has issued a new rule. According to this, if your bank balance goes into minus then the bank cannot charge interest on it. That is, if you want to close any of your bank accounts whose balance is in minus, then you will not have to pay anything separately for this.

RBI New Rule On Negative Balance: There was a time when one had to stand in line for hours to complete bank related work. But ever since smartphones have arrived and banking services have gone online, almost all bank related work is done on the phone. However, this has also created some problems. Many people have now started keeping more than one bank account. This has made it difficult to maintain minimum balance and in many situations the balance even goes into minus.

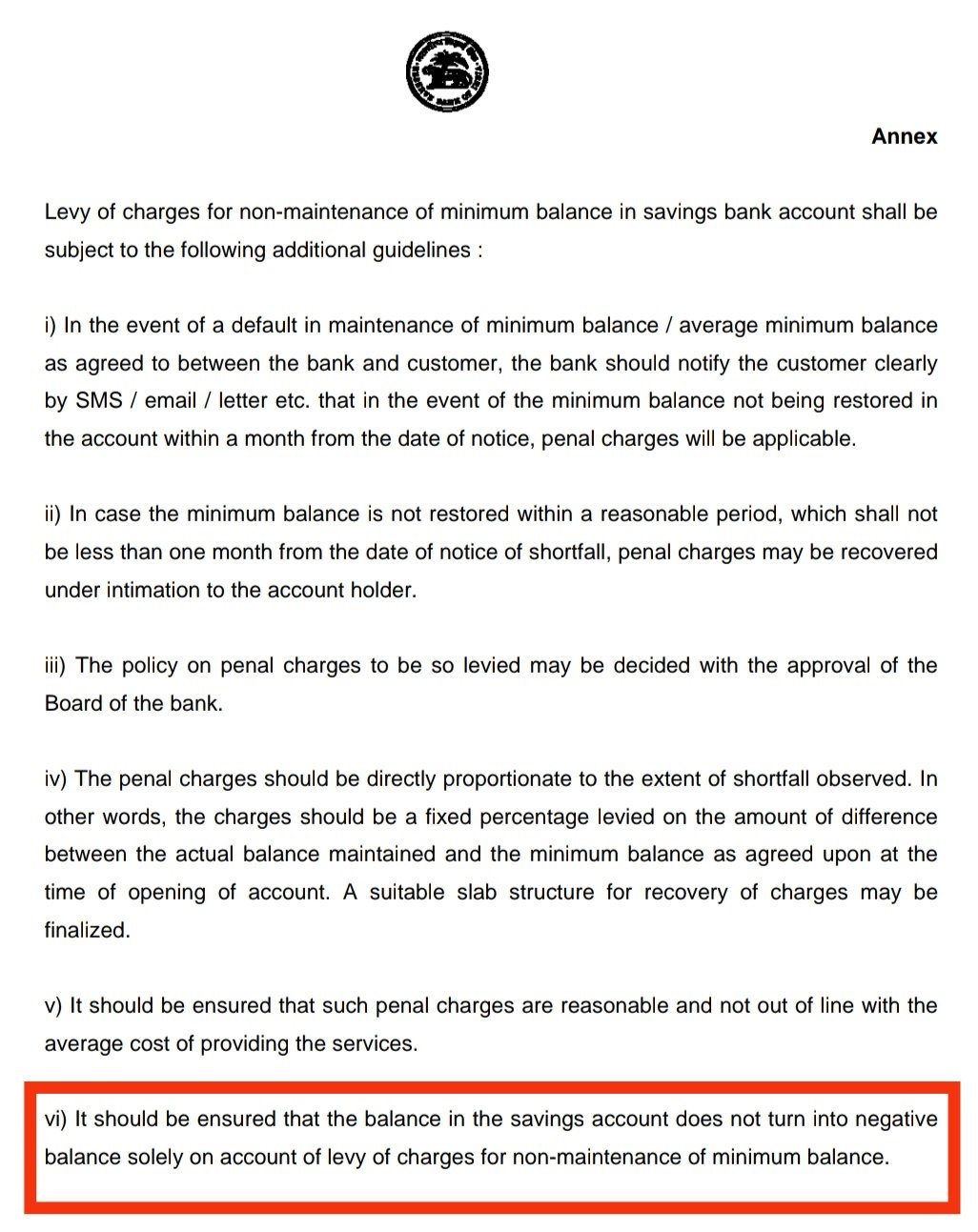

In such a situation, if you ask the bank to close the account, then you are asked to pay the amount which is in minus. But, now the Reserve Bank of India has worked to provide relief to the customers facing such situations. According to the new rules of RBI, if you have not maintained the minimum balance then it can become zero but banks cannot make it minus by charging interest on it.

RBI New Rule On Negative Balance: There was a time when one had to stand in line for hours to complete bank related work. But ever since smartphones have arrived and banking services have gone online, almost all bank related work is done on the phone. However, this has also created some problems. Many people have now started keeping more than one bank account. This has made it difficult to maintain minimum balance and in many situations the balance even goes into minus.

In such a situation, if you ask the bank to close the account, then you are asked to pay the amount which is in minus. But, now the Reserve Bank of India has worked to provide relief to the customers facing such situations. According to the new rules of RBI, if you have not maintained the minimum balance then it can become zero but banks cannot make it minus by charging interest on it.

Account can be closed without paying charges

Even if the balance in your account is showing in minus, banks cannot ask the customer to pay this amount. The bank does not have the right to demand the amount of the balance which has gone negative.

As per RBI guidelines, you do not need to pay a single rupee even if you have a minus balance. This means that your bank account can be closed without any extra charges. Banks cannot take money for this.