This is not the first time that RBI has issued such instructions on a bank. Earlier, RBI had imposed similar restrictions on withdrawals in PMC Bank and Yes Bank.

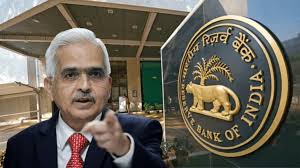

The Reserve Bank of India (RBI) has imposed many restrictions including withdrawal of money from a co-operative bank, due to which customers associated with this bank will not be able to withdraw money for the next 6 months. Apart from this, the bank has also been refused permission to give loan or other amount. Due to this step of RBI, thousands of depositors of co-operative banks are worried because they are not able to withdraw their deposits from the bank.

The Central Bank has imposed this ban on Shirpur Merchants Co-operative Bank of Maharashtra. According to the ET report, this is not the first time that RBI has issued such instructions on a bank. Earlier, RBI had imposed similar restrictions on withdrawals in PMC Bank and Yes Bank. RBI has imposed this restriction keeping in view the financial condition of the bank.

What should customers do if a bank fails?

What rights do customers have when a bank fails or is foreclosed on? What should Shirpur Merchants Co-operative Bank customers do now? Let us know. However, before that let us know what RBI said. According to the central bank, the bank will not grant or renew any loan or advance without the approval of RBI. Also no one will invest.

What rights do customers have?

If a bank fails, as per the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act, every depositor of a bank has a deposit insurance cover of up to Rs 5 lakh, which covers the principal and interest in their accounts with that particular bank. Amount is included. The insurance cover amount applies to all deposits taken together, irrespective of the account.

When will you get the money back?

Under deposit insurance, an amount up to Rs 5 lakh is released to customers within 90 days. RBI said that customers of Shirpur Merchants Co-operative Bank can visit the official website of the bank for more information.