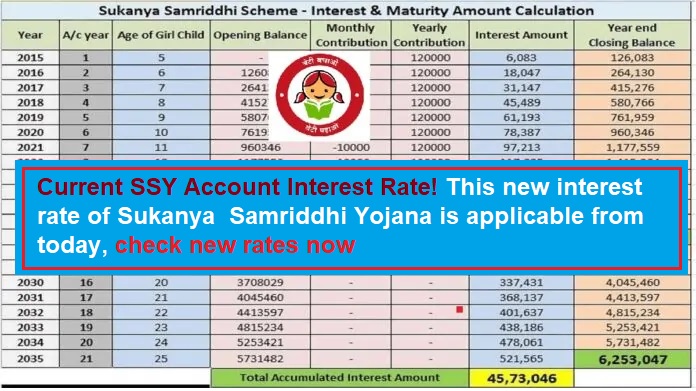

Sukanya Samriddhi Yojana Latest Interest Rate: The purpose of the Sukanya Samriddhi Yojana scheme is to improve the girl child in the country. Sukanya Samriddhi Yojana has been started to provide means of savings to the girl child in every family. The tenure of SSY is 21 years from the date of account opening or till the girl’s marriage after attaining the age of 18 years.

At present, the interest rate of the SSY scheme has been reduced from 8.4% to 7.6% and is compounded on an annual basis. No interest is payable after the completion of the term of the scheme or if the girl child becomes a Non-Resident Indian (NRI) or a non-citizen. The interest rate is fixed by the government and is determined on a quarterly basis.

Features of Sukanya Samriddhi Yojana

The salient features of SSY account are mentioned in the table below:

| Properties | description |

|---|---|

| account operation |

|

| amount credited to account | The minimum and maximum deposits in the account in a financial year are Rs 500 and Rs 1.5 lakh respectively. Deposits can be made in multiples of 100. |

| plan period | Deposits for the scheme should be made for a period of 15 years. However, this scheme matures after 21 years. |

| transfer of account | An SSY account can be transferred anywhere in India from post offices to banks and vice versa. No charges will be levied for account transfer. However, a proof must be submitted for change of residence. If no proof is produced, a fee of Rs 100 will be levied. |

| deposit method | Deposits in the account can be made in the form of online transfer, demand draft, check or cash. |

Documents required to open SSY account –

- SSY Account Opening Form.

- The birth certificate of the girl child has to be submitted at the time of opening the account.

- The ID proof and address proof of the depositor have to be submitted while opening the account.

- In case of multiple births under one order of birth, a medical certificate has to be submitted.

- Any other document that is requested by the bank or post office.

Sukanya Samriddhi yojana interest rate

| Time | Rate of interest |

|---|---|

| 01.04.2020 to 31.03.2022 | 7.6 |

| 01.01.2018 to 30.09.2018 | 8.1 |

| 01.07.2017 to 31.12.2017 | 8.3 |

| 01.04.2017 to 30.06.2017 | 8.4 |

| 01.07.2019 to 31.03.2020 | 8.4 |

| 01.10.2016 to 31.03.2017 | 8.5 |

| 01.10.2018 to 30.06.2019 | 8.5 |

| 01.04.2016 to 30.09.2016 | 8.6 |

| 03.12.2014 to 31.03.2015 | 9.1 |

| 01.04.2015 to 31.03.2016 | 9.2 |