Paytm Payments Bank News: RBI has taken major action against Paytm Payments Bank, after which EPFO has also decided to ban the settlement of claims.

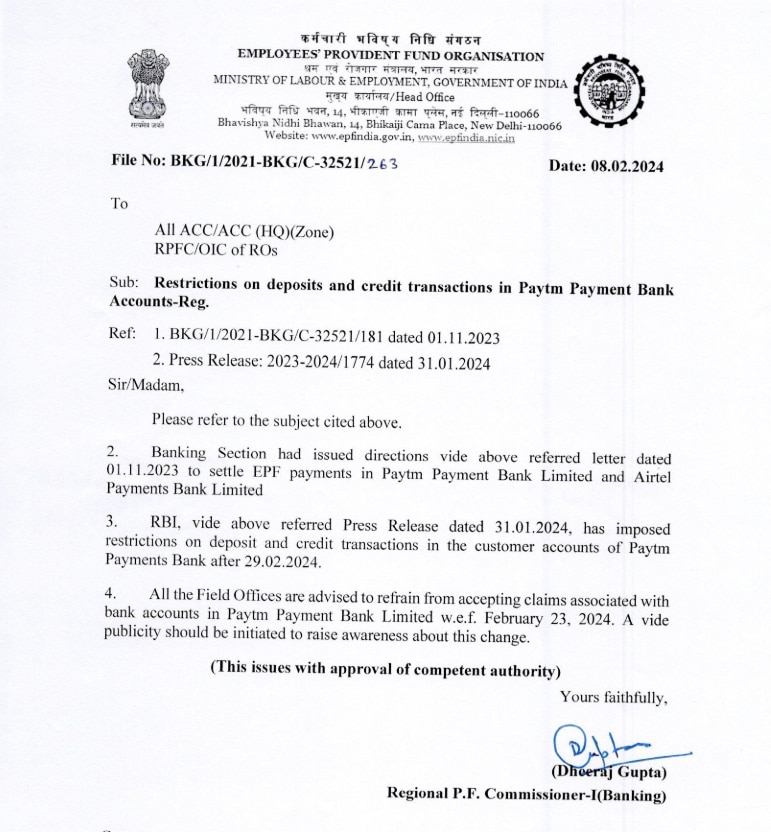

EPFO On Paytm Payments Bank: Those EPFO subscribers who claim through Paytm Payments Bank account are going to get a big shock. The Employee Provident Fund Organization (EPFO) has issued a circular to its field offices and has ordered that from February 23, 2024, they should not accept such claims whose bank account is linked with Paytm Payments Bank.

Ban on settling EPF claims in Paytm Payments Bank!

EPFO has issued a circular to all field offices on 8 February 2024. It is written in this circular that the Banking Section had issued an order on 1 November 2023 to settle the payments of EPF claims in the accounts of Paytm Payments Bank and Airtel Payments Bank also. But on January 31, 2024, the Reserve Bank of India has banned credit or deposit transactions in the accounts of Paytm Payments Bank customers from February 29, 2024.

In this circular, EPFO has banned all field offices in such a situation from settling EPF claims in the bank account of Paytm Payments Bank from 23 February 2024. EPFO has also asked field offices to run an awareness campaign in this regard.

Difficulty increased due to strictness of RBI

In fact, on January 31, 2024, RBI took major action against Paytm Payments Bank and banned the addition of new customers. Paytm is accused of committing irregularities regarding banking regulation. After February 29, 2024, no customer will be able to deposit money or do credit transactions in Paytm Wallet nor will be able to top up Paytm Wallet.

The balance amount remaining in the customer’s wallet can be used till it is exhausted. However, in the next one week, RBI will issue FAQs to eliminate the confusion spread among customers regarding this entire matter.