UPI: If you also make automatic payment through UPI, then there is good news for you. The Reserve Bank of India (RBI) on Tuesday increased the limit for automatic payment through UPI from Rs 15,000 to Rs 1 lakh per transaction for some categories.

According to media report, mutual funds have also been included in its scope. NPCI has provided the facility of UPI AUTOPAY for recurring payments. With this new feature, customers can now enable recurring e-mandate using any UPI application for recurring payments like mobile bills, electricity bills, EMI payments, entertainment/OTT subscriptions, insurance, mutual funds etc.

Read More: Paytm great Offers! You will get a discount of up to ₹ 3000 on flight tickets – Details Here |

These were also included in the scope of payment

According to the news, till now there has been relaxation in ‘Additional Factor of Authentication’ (AFA) while executing e-instructions/standing instructions on cards, prepaid payment instruments and UPI (Unified Payments Interface) for recurring transactions above Rs 15,000.

There is approval. In a circular issued on ‘Execution of e-instructions for recurring transactions’, RBI said it has decided to increase the per transaction limit for mutual fund subscription, payment of insurance premium and credit card bill payment to Rs 1,00,000. Has gone.

Governor Shaktikanta Das had announced

Reserve Bank Governor Shaktikanta Das, during the bi-monthly monetary policy review last week, had announced increasing the limit for automated transactions through UPI from Rs 15,000 to Rs 1 lakh. With more than 11.23 billion transactions in the month of November, UPI has emerged as the preferred method of digital payment for a large section of the population.

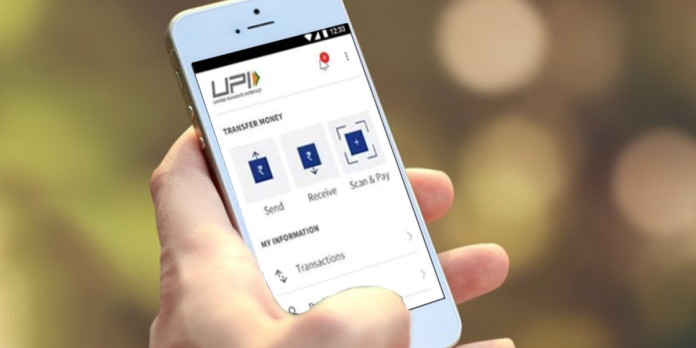

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application, merging multiple banking features, seamless fund routing and merchant payments under one hood.