The last date for filing income tax return for the financial year 2022-23 has been fixed as 31 July. Till July 27, only 73 per cent ITRs have been filed. Many taxpayers have complained to the Income Tax Department about facing difficulties in filing through tweets and emails, after which the Income Tax Department has issued helpline numbers, chatbots and emails for 24 hours. With their help, taxpayers can get their problems resolved quickly.

According to the data of the Income Tax Department, till July 27, only 5.3 crore ITRs have been filed. Out of these, 4.46 crore ITRs have also been e-verified. Out of the total ITRs that have been verified, more than 2.69 crore ITRs have also been processed for the next process.

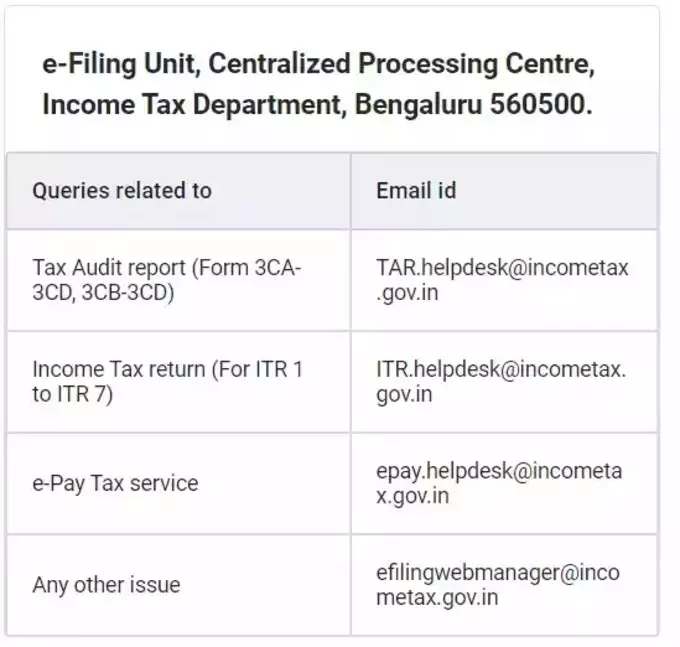

According to the statistics of the Income Tax Department, still a large number of taxpayers have not been able to file ITR. Many of them have complained of difficulty in filing. The Income Tax Department has said that it will provide assistance to taxpayers on 24×7 basis for filing ITR. Check the helpline number, email for filing income tax return.

CBDT is urging those taxpayers who have not filed ITR for Assessment Year 2023-24, to file their ITR at the earliest to avoid last minute rush. Taxpayers can seek help from the Income Tax Department through calls, live chats, webex sessions and social media.

According to the official tweet of Income Tax Department, our helpdesk will assist taxpayers for ITR filing, tax payment and other related services on 24×7 basis. We are providing support through calls, live chat, webex sessions and social media. We will continue to provide support till 31st July 2023 including Saturdays and Sundays.

E-filing and Centralized Processing Center for e-filing of income tax returns or forms and other services and taxpayers for information, corrections, refunds and other income tax processing related queries 8:00 am – 23:59 pm Thu 27 to Mon 31 You can take help through call, email or chatbox till July 23.

Helpline numbers to help taxpayers

- 1800 103 0025

- 1800 419 0025

- +91-80-46122000

- +91-80-61464700

- Taxpayers can also email to orm@cpc.incometax.gov.in with PAN and their mobile number.

- AIS TIS, SFT can take help by calling contact number 1800 103 4215 for initial response, e-campaign or e-verification related issues.