LIC Jeevan Labh Policy: LIC’s plans are most popular for life insurance policy in the country. Life Insurance Corporation of India also offers many types of plans keeping in view the different needs of the people. There is a lot of discussion about LIC’s Jeevan Labh policy these days. The special thing is that the benefit of both insurance and savings is available in this plan. This is an endowment plan, in which a lump sum amount along with bonus is paid after a specified period.

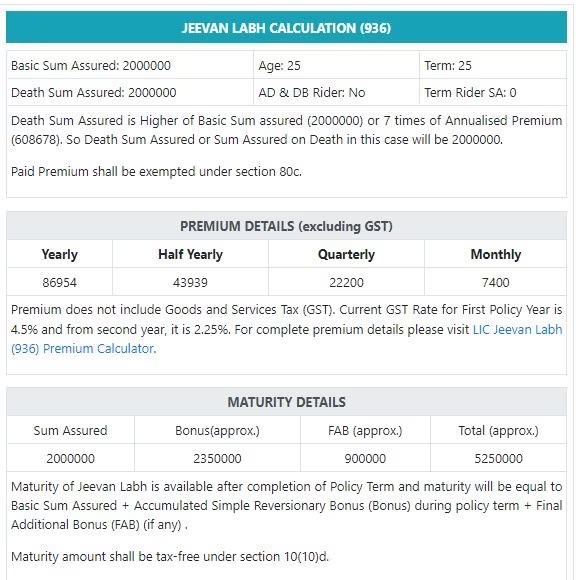

You can invest in LIC’s Jeevan Labh Plan 936 with various objectives. These days there is a discussion about this policy that through this you can get Rs 54 lakh on maturity by saving only Rs 7,572 every month. Let us tell you how?

Features of Jeevan Labh Plan:

In the Jeevan Labh Plan of Life Insurance Corporation of India, investors get the option to choose the amount and term of the premium as per their choice. In this plan, if the policy holder survives till maturity, he gets a huge maturity amount along with other benefits including sum assured and bonus. On the other hand, on the unfortunate death of the insured, the nominee is paid sick money and bonus.

How to get 52 lakhs from 250 rupees daily?

The minimum age for buying a Jeevan Labh policy is 18 years and the maximum is 59 years. Suppose, if a person at the age of 25 years takes a Jeevan Labh policy for a term of 25 years, he will have to invest Rs.7400 per month or Rs.246 per day. Accordingly, this amount will be Rs 86,954 annually and on maturity he will get an amount of Rs 52,50,000 lakh. This includes the benefit of Sum Assured and Reversionary Bonus and Final Additional Bonus. However, the rate of bonus keeps changing, hence the maturity amount may change.

The policy can be bought in the name of children as well.

The special thing about this scheme is that it is available from children to old age people. Any citizen between 8 years to 59 years can invest in Jeevan Labh Yojana. Insurance holders can deposit money for the policy term 10, 13 and 16 years. Whereas, money is given on maturity in the period of 16 to 25 years. A person of 59 years can choose an insurance policy for 16 years, so that his age does not exceed 75 years.