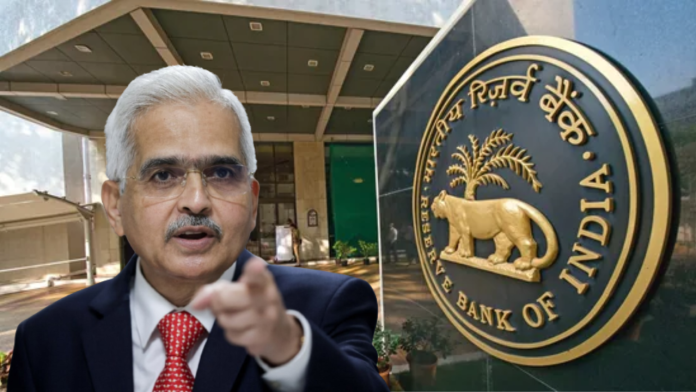

RBI cancels Mahalaxmi Cooperative Bank: The Reserve Bank of India (RBI) has canceled the banking license of Karnataka-based Mahalaxmi Cooperative Bank. Now this bank will work only like a non-banking finance company (NBFC).

The central bank informed that this has become effective from the close of business on June 27, 2023. The Reserve Bank said that the Mahalaxmi Co-operative Bank Limited will continue to function as a non-banking institution. Explain that the Reserve Bank had given the license for Mahalaxmi Cooperative Bank on March 23, 1994.

Increasing strictness of Reserve Bank: Central Reserve Bank has been increasing strictness on co-operative banks for some time. For example, in April 2023, the Central Reserve Bank canceled the banking license of Adoor Co-operative Urban and allowed it to operate only as an NBFC. At the same time, in the financial year 2023, the licenses of nine lenders have been cancelled.

Earlier on Monday, the Reserve Bank had imposed penalty on seven cooperative banks for violation/non-compliance of certain norms. These co-operative banks were Textile Traders Co-operative Bank Limited, Ujjain Nagrik Sahakari Bank Maryadit, Panihati Co-operative Bank, The Berhampur Co-operative Urban Bank, Solapur Siddheshwar Sahakari Bank, Uttar Pradesh Co-operative Bank Limited and Uttarpara Co-operative Bank. There are banks.

The central bank had imposed a penalty of Rs 28 lakh on the Uttar Pradesh Co-operative Bank Ltd. A fine of ₹4.50 lakh was imposed on Textile Traders Co-operative Bank Ltd. Besides this, the central bank imposed a penalty of ₹2.50 lakh each on Panihati Cooperative Bank and Uttarpara Cooperative Bank. A fine of ₹1.50 lakh was imposed on Solapur Siddheshwar Sahakari Bank and ₹1 lakh each on Ujjain Nagrik Sahakari Bank Maryadit and The Berhampur Sahakari Urban Bank.