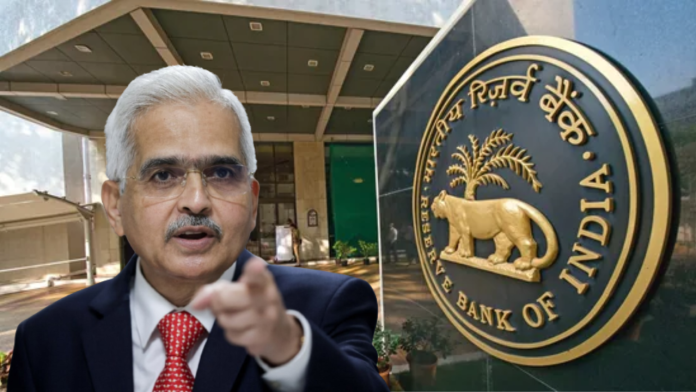

Reserve Bank of India: Many major decisions have been taken from time to time by RBI regarding banks.

If you also have an account in any bank, then this is important news for you. The Reserve Bank of India (RBI) imposed a penalty of Rs 2.20 crore on public sector Indian Overseas Bank (IOB) for non-compliance with rules related to income recognition and other deficiencies in regulatory compliance.

violated the rules

This fine has been imposed for violation of the provisions of certain instructions of RBI. These include ‘Prudential Norms on Income Recognition, Asset Classification and Provisions relating to Advances etc. The RBI said the action is based on deficiencies in regulatory compliance and is not concerned with the validity of any transaction or agreement entered into by the bank with its customers.

The central bank informed

that the statutory inspection (ISE 2021) for the supervisory assessment of the bank was done by the RBI on March 31, 2021 with reference to its financial position. The Chennai-based bank failed to make the minimum mandatory transfer of an amount equal to 25 per cent of the declared profit for the year 2020-21 to its reserve fund.

Central Bank was fined last week

Earlier, RBI had also imposed heavy fine on Central Bank. The Reserve Bank of India said it had imposed a penalty of Rs 84.50 lakh on public sector Central Bank of India (CBI) for non-compliance with certain provisions of norms relating to fraud classification and reporting.

Why was the penalty imposed?

The Reserve Bank had conducted a statutory inspection for supervisory assessment of the bank’s financial position as on March 31, 2021. Scrutiny of the report revealed that the bank did not report the fraud to the RBI within seven days of the decision to declare the accounts of the Joint Forum of Lenders (JFL) as frauds. The bank charged its customers for SMS Alerts on a flat basis instead of actual usage basis.