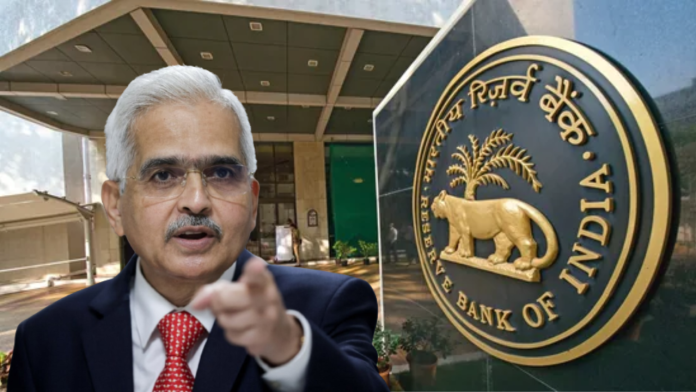

Bank Locker New Rules: RBI has extended the time of revised agreement with banks till the end of December this year, giving relief to the existing locker customers.

In a release issued by the central bank, it has been said that the deadline will be extended till December 31, 2023 in a phased manner. It is being told that this step has been taken after receiving complaints from a large number of customers.

Instructions to ease the process of agreement renewal

Earlier in August 2021, the RBI had asked banks to renegotiate with the existing locker holders by January 1, 2023, after all the changes in the banking and technology sector. The apex bank said in a release that the deadline will be extended in a phased manner till December 31 this year.

Under this, the process will be completed by 50 percent by June 30, 2023, by September 30 and 75 percent by 2023. RBI has asked banks to make necessary arrangements to ease the process of agreement renewal by ensuring availability of stamp paper etc.

RBI gave this instruction regarding freeze lockers

Apart from this, the Reserve Bank of India has given instructions to start the lockers which are frozen due to lack of agreement from January 1, 2023, with immediate effect. Let us tell you that in August 2022, the central bank had issued new rules related to the safe deposit locker, issued a circular.

Under this, banks had to revise the agreement with the existing locker holders by January 1, 2023. These rules were to be applicable to the old locker holders. These rules are applicable to new customers from January 2022 only.

Banks will have to show list of empty lockers

Under the new rules, banks will be required to display a list of empty lockers and a waiting list. Apart from this, banks will have the right to charge locker rent from customers for a maximum period of three years at a time. The great thing is that in the event of a loss to a customer, he will no longer be able to retract by citing the bank’s conditions. Rather, the customer has to be reimbursed in full.

Know what is the revised rules of RBI

According to the revised rules of RBI, banks will have to ensure that no unfair condition is included in the locker agreement done by them, so that the bank can easily walk away if the customer is at a loss. Actually, RBI has made this change in the rules to protect the interests of bank customers. In case of any damage to the contents of the locker due to the negligence of the bank, as per RBI norms, will be eligible to pay. It is the responsibility of the banks to take all steps for the security of the premises in which the lockers are located.