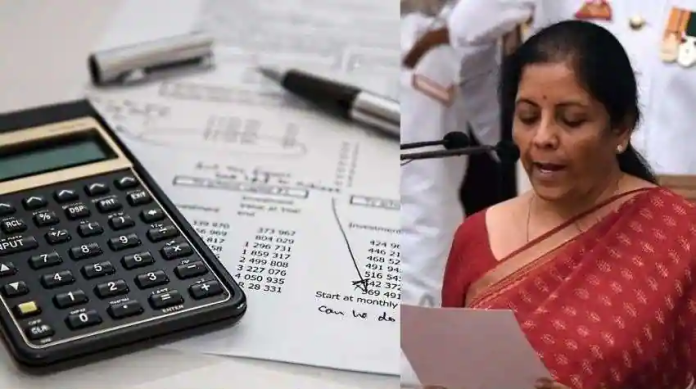

Finance Minister Nirmala Sitharaman presented the country’s general budget (Union Budget 2023) on Wednesday. Many big announcements have been made in this budget. Under the simplified tax regime, new income tax slabs and rates were proposed in the budget. However, the announcement of new tax slabs and rates under the new regime has raised many questions in the minds of senior citizens and retired employees.

Senior citizens can file their Income Tax Returns under Old Tax Regime or New Tax Regime. Both the options will be available when they go to file ITR for assessment year 2023-24. There is no change in this regard. However, the new tax regime will appear as the default regime on the e-filing website. Senior citizens will also have the option of going for the old tax regime.

Which tax slab and rate will be applicable?

If you are filing ITR this year (for Assessment Year 2023-24 or Financial Year 2022-23), then the applicable tax slab and return filing rates will be the same as last year.

Tax slabs and rates for senior citizens-

New Tax Regime Slabs and Rates for ITR Filing in AY2023-24 (FY 2022-23) Rs

0 to

Rs 2.5 Lakh – Rs 0 to Rs 2.5 Lakh – 5% Above Rs 2.5 Lakh Rs

5 Lakh to Rs 7.5 Lakh – 12,500 Rs.5 lakh + 10% above

Rs.7.5 lakh to Rs.10 lakh – Rs.37,500 + 15% above Rs.7.5

lakh Rs.10 lakh to Rs.12.5 lakh – Rs.75,000 + 20% above Rs.10 lakh from

Rs.12.5 lakh 15 Above Rs.15 lakhs – Rs.1,25,000 + 25% above

Rs.12.5 lakhs Above Rs.15 lakhs – Rs.1,87,500 + 30% above Rs.15 lakhs

Old Tax Regime Slabs and Rates for ITR Filing in AY2023-24 (FY2022-23) Rs.3 Lakh-

0 Rs.3-5 Lakh-

5% Above Rs.3 Lakh Rs.5-10 Lakh- Above

Rs.10,000 + Rs.5 Lakh 20%

above Rs 10 lakh – Rs 1,10,000 + 30% above Rs 10 lakh

New Tax Regime Slabs and Rates for ITR Filing in AY2024-25 (FY 2023-24)- Rs

0-3 Lakh- 0

Rs 3-6 Lakh- 5%

Rs 6-9 Lakh- 10% Rs

9-12 Lakh- 15%

Rs 12-15 lakh – 20% Above

Rs 15 lakh – 30%